₹ 3,000 worth Annual Movie Tickets

Overview

Overview

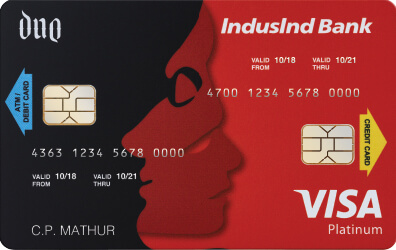

The IndusInd Bank Duo Card comes with two Magnetic stripes & EMV Chips. Simply dip/swipe or enter the relevant card details to enjoy the convenience, flexibility and freedom to choose how you pay as well as access cash without carrying multiple cards.

What’s more, This first-of-its-kind Card in India brings together a variety of benefits that treat you to the very best of a Credit and Debit Card.

2% Cross Currency Mark-up

₹ 249 + Taxes Issuance Fee

Free Annual Fee

Daily Limits: ₹ 1,25,000/- ATM ; ₹ 2,00,000/- POS (Point-of-Sale)

*Please visit the 'A Rewarding Life' section for changes in Cash Credit redemption.

Notice

Rewards

Features of IndusInd Bank Duo Debit Card

Benefits

- T&C applicable on Duo Debit Card: No fuel surcharge is applicable on your debit card. This is subject to Govt. regulations and may be revised overtime as per Govt. of India directive.

- T&C applicable on Duo Credit Card

- Waiver of 1% fuel surcharge is across all petrol pumps in India.

Terms & Conditions applicable on Duo Debit Card:

The following insurance is applicable on Duo Debit card:

- Lost Card Liability (Rs. 3,00,000) + Air accident Insurance (Rs. 25,00,000) + Personal Accident Insurance (Rs. 2,00,000) + Purchase Protection (Rs. 50,000)

- Terms & conditions apply. Click here

To know about steps to claim insurance cover- click here

Terms & Conditions applicable on Duo Credit Card

Travel Insurance Cover Details:

IndusInd Bank has tied up with ICICI Lombard General Insurance Company Limited("Insurance Company") as a group manager to provide Card holders with the following insurance cover under the Program:

| Insurance cover | Sum assured (up to) |

| Lost baggage | Rs. 100,000 |

| Delayed baggage | Rs. 25,000 |

| Loss of passport | Rs. 50,000 |

| Lost ticket | Rs. 25,000 |

| Missed connection | Rs. 25,000 |

- Click here for Duo Credit Card terms and conditions

Total Protect:

You don't need to worry about fraudulent usage of your card anymore. 'Total Protect' is a first- of- its- kind program which covers you for a sum up to the credit limit on your Credit Card and is available on add-on cards as well. With us, you can be worry free about fraudulent usage of your card.

'Total Protect' covers you for the following:-

- Unauthorised Transactions in case of loss/ theft of Card: We provide an insurance cover up to 48 hours prior to you reporting the loss of your Card to IndusInd Bank.

- Counterfeit Fraud: It is possible that your Card details are stolen and used unscrupulously by producing counterfeit plastic. We offer you insurance to protect yourself against such incidents. Click here for terms and conditions of the applicable insurance policy:

Air accident cover:

With the IndusInd Bank DUO Credit Card, you also get a complimentary Personal Air Accident insurance cover of up to Rs.25 lakh.

With IndusInd Bank around to lend you a helping hand, you have very little to worry about.

Click here for terms and conditions.

- Please note that the address given in the DUO application form will be used for all communication, if you are a New to Bank Credit Card and Savings Account Customer.

- In case you hold an existing Credit Card Account but not a Savings Account, the mailing address as updated in our records will be used for all Credit Card communication and for delivery of your DUO Card.

- In case you have an existing Savings Account but not a Credit Card Account, the address given in the DUO application form will be used for all Credit Card communication and your DUO Card will be delivered on the referred address. Your Savings Account address will remain unchanged, as per the Bank’s records.

- Supplementary/Add-on Cards cannot be issued on DUO Cards.

- For update of any contact details on DUO Credit Card, customer will need to call the 24/7 helpline number. For update of any contact details on DUO Debit Card, customer will need to visit the nearest branch.

- In case, the customer wants to block his DUO Card, he will need to call the 24/7 helpline number. In case, the customer wants to block his DUO Card through IndusMobile app, both Debit & Credit Cards will need to be blocked separately.

Duo Usage

1) How to use your Duo Card

Your IndusInd Bank Duo Card comes with two EMV Chips & PINs. Thus it provides you with enhanced security for all your domestic and international transactions, in line with the best global practices on security of transactions.

2) How to use your Duo Card at an ATM -

You can use your IndusInd Bank Duo Card as an ATM/Debit Card by entering your Debit Card PIN to withdraw funds from your Bank Account, and to conduct other Banking transactions at an ATM. Please ensure to insert your Duo Card in to the ATM card slot from the ‘ATM/Debit Card’ (blue arrow) side. Debit Transactions initiated with your Duo Card and your Debit Card PIN will appear on the statement we send to you for your IndusInd Bank Account.

- You can also use your IndusInd Bank Duo Card as a Credit Card by entering your Credit Card PIN to obtain a Cash Advance against your Credit Card Cash Limit. Cash Advance and Interest Charges will be applicable for such Cash Advances. Please refer to the Schedule of Charges for more details. Please ensure to insert your Duo Card into the ATM card slot from the ‘Credit Card’ (yellow arrow) side. Cash Advance Transactions initiated with your Duo Card and your Credit Card PIN will appear on the monthly Credit Card statement.

3) How to use your Duo Card at Point-of-Sale Merchant Establishments –

- To pay for transactions using the funds in your IndusInd Bank Account, please ensure to insert your Duo Card into a POS Machine slot from the ‘ATM/Debit Card’ (blue arrow) side and enter your Debit Card PIN. Such Purchase Transactions initiated with your Duo Card and your Debit Card PIN will appear on the statement we send to you for your Bank Account.

- To pay for transactions using the assigned Credit Card Limit, please ensure to insert your Duo Card into the POS Machine slot from the ‘Credit Card’ (yellow arrow) side and enter your Credit Card PIN. Such Purchase Transactions initiated with your Duo Card and your Credit Card PIN will appear on the monthly Credit Card statement.

- To pay for transactions at Non Chip and PIN POS Merchant Terminals, please ensure to swipe your Duo Card Magstripe as per your preferred Debit/Credit Card option and enter the appropriate PIN to complete the transaction.

4) How to use your Duo Card Online – You can use your IndusInd Bank Duo Card to shop online, pay for services, or make utility bill payments.

- For online transactions using the funds in your IndusInd Bank Account, please enter your Debit Card Credentials (Card Number, Expiry Date, CVV) on the Merchant Website to make the payment. You can authenticate the online transaction using the Verified By Visa (VBV) Password or the One Time Password (OTP), which will be sent on your Registered Mobile Number. Such Online Transactions initiated with your Duo Debit Card details will appear on the statement we send to you for your Bank Account.

- For online transactions using the assigned Credit Card Limit, please enter your Credit Card Credentials (Card Number, Expiry Date, CVV) on the Merchant Website to make the payment. You can authenticate the online transaction using the Verified By Visa (VBV) Password or the One Time Password (OTP), which will be sent on your Registered Mobile Number/Email Address. Such Online Transactions initiated with your Duo Credit Card details will appear on the monthly Credit Card statement.

Value Table

DUO Card Privileges

| Annual Estimation | |

|---|---|

| DUO Privileges | Savings on Market Value |

| Movie tickets (2*12*250) | ₹ 6,000 |

| Savings on Fuel Surcharge | ₹ 2,400 |

| Annual value of Reward Points on an average spend of ₹ 30,000 per month (200*12*0.75) | ₹ 1,800 |

| Total Savings | ₹ 10200 |

Duo Plus

Joining Fees - ₹ 1500

Annual Fees - ₹ 799

Voucher value - ₹ 1000

Voucher will be of any of the following brands: Bata, United Colors of Benetton, Levis, Pantaloons, Pizza Hut

Duo Premier

Joining Fees - ₹ 3000

Annual Fees - ₹ 799

Voucher value - ₹ 3000

Voucher will be of any of the following brands: Louis Philippe, Titan, Aldo, Bata, Fab Hotels, Marks & Spencer