IndusInd Bank Q2FY 18 Net Profit up by 25 % to Rs 880.10 crores, NIM stable at 4.00%

Posted on Monday, October 23rd, 2017 | By IndusInd Bank

Key Performance Highlights Q2 FY 2018

- A quarter of steadfast performance

- Deposit growth up 26% Y-o-Y

- Saving Deposit Growth up 95% Y-o-Y

- Credit growth up 24% Y-o-Y

- Net Interest Income up 25 % Y-o-Y

- Operating profit up 27 % Y-o-Y

- Return on Assets (ROA) up at 1.90 %

- Capital Adequacy Ratio (CRAR) at 15.63 %

- Net NPA at 0.44%

Mumbai, October 12 2017: The Board of Directors of IndusInd Bank Ltd. today approved and adopted its Unaudited Financial Results for the second quarter and first half-year ended September 30, 2017.

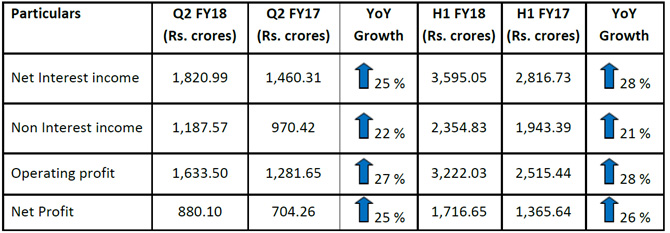

Performance Highlights at a Glance:

Performance highlights for the Quarter ended September 30, 2017:

- Net Interest Income (NII) was Rs. 1,820.99 crores as against Rs. 1,460.31 crores in the corresponding quarter of the previous year, registering a robust growth of 25 %.

- Non Interest income for the quarter was Rs. 1,187.57 crores as against Rs. 970.42 crores in the corresponding quarter of the previous year, a growth of 22 %

- Core fee income for the quarter was Rs. 1,013.02 crores as against Rs. 825.57 crores in the corresponding quarter of the previous year, marking a growth of 23 %

- Operating Profit for the quarter was Rs. 1,633.50 crores as against Rs. 1,281.65 crores in the corresponding quarter of the previous year, showing a growth of 27 %.

- Net Profit for the quarter was Rs. 880.10 crores as against Rs. 704.26 crores in the corresponding quarter of the previous year, showing a growth of 25 %.

- Net Interest Margin (NIM) was stable at 4.00% for the current quarter and the corresponding quarter of the previous year.

Performance highlights for the Half year ended September 30, 2017:

- Net Interest Income (NII) for the half year ended September 30, 2017 was Rs. 3,595.05 crores as against Rs. 2,816.73 crores in the corresponding period of the previous year, registering a robust growth of 28 %.

- Non-Interest income was at Rs. 2,354.83 crores as against Rs. 1,943.39 crores in the corresponding period of the previous year, a growth of 21 %

- Core fee income was Rs. 1,987.06 crores as against Rs. 1,607.48 crores in the corresponding period of the previous year, marking a growth of 24 %

- Operating Profit for the half year ended September 30, 2017 was Rs. 3,222.03 crores as against Rs. 2,515.44 crores in the corresponding period of the previous year, a growth of 28 %.

- Net Profit for the half year ended September 30, 2017 was Rs. 1,716.65 crores as against Rs. 1,365.64 crores in the corresponding period of the previous year, showing a growth of 26 %.

- Net Interest Margin (NIM) for the half year ended September 30, 2017 was 4.00% as against 3.97 % in the corresponding period of the previous year.

- CASA (Current Accounts- Savings Accounts) Ratio improved to 42.26 % against 36.53 % and Saving deposit grew by 95% Y-o-Y from 20,567 crores in September 2016 to 40,157 crores in

September 2017. - Total Advances as on September 30, 2017 were at Rs.1,23,181 crores as compared to Rs. 98,949 crores in the corresponding period of the previous year, recording a growth of 24%.

- Total deposits as on September 30, 2017 were at Rs. 1,41,441 crores as compared to Rs. 1,12,313 crores in the corresponding period of the previous year, up by 26 %. Total Business at

Rs. 2,64,622 crores. - Net NPA as on September 30, 2017 was at 0.44% as against 0.37% as at September 30, 2016.

- Increase in network to Branches and ATMs as on September 30, 2017 at 1,250 Branches and 2146 ATMs as against 1,035 Branches and 1,935 ATMs as on September 30, 2016.

Commenting on the performance, Mr. Romesh Sobti, MD & CEO, IndusInd Bank said,

“At the moment, India is best poised for growth and this is reflected in the positive growth story during the quarter. Banks have adapted to the customers’ needs and are offering solutions that are need and situation based. Digitization is giving the much needed thrust to the vision of a cashless economy, and businesses are treading classified in the same direction. Against such dynamic changes in the economy, the Bank has maintained its sustained financials with steady numbers. The total business of the Bank has increased to Rs. 2,64,622 crores and we have maintained our NIM at 4.00 % .

In keeping with the agenda to increase digital payment capacity, IndusInd Bank is proud to have partnered with Indraprastha Gas Limited (IGL) and will be the sole provider of prepaid CNG smartcards for commercial and private vehicles, facilitating cashless transactions at all IGL’s CNG gas stations.”

About IndusInd Bank

IndusInd Bank, which commenced operations in 1994, caters to the needs of both consumer and corporate customers. Its technology platform supports multi-channel delivery capabilities. As on

September 30, 2017, IndusInd Bank has 1250 branches, and 2146 ATMs spread across 690 geographical locations of the country. The Bank also has representative offices in London, Dubai and Abu Dhabi. The Bank believes in driving its business through technology. It enjoys clearing bank status for both major stock exchanges – BSE and NSE – and major commodity exchanges in the country, including MCX, NCDEX, and NMCE. IndusInd Bank on April 1, 2013 was included in the NIFTY 50 benchmark index. In the recently released Kantar Millward Brown’s BRANDZ Top 50 most valuable Indian Brands 2017 report, IndusInd Bank has retained its 12th position and has been ranked No.6 amongst banks as per the Top 50 Indian Brands.

Ratings:

- CRISIL AA + for Infra Bonds program

- CRISIL AA for Additional Tier I Bonds program

- CRISIL A1+ for certificate of deposit program

- IND AA+ for Senior bonds program by India Ratings and Research

- IND AA for Additional Tier I Bonds program by India Ratings and Research

- IND A1+ for Short Term Debt Instruments by India Ratings and Research

Visit us at www.indusind.com

Twitter- @MyIndusIndBank

Facebook – https://www.facebook.com/OfficialIndusIndBankPage/

| For more details on this release, please contact: | ||

| Anu Raj | Neha Rao | |

| IndusInd Bank Ltd. | Adfactors PR Pvt. Ltd. | |

| mktg@indusind.com | neha.rao@adfactorspr.com 9819073603 | |

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release