1,59,266

Total Savings*

SFlexible options to pay through EMI, Reward points or Credit.

This first-of-its-kind card in India brings together a variety of benefits that treat you to the very best of a Credit and Debit Card.

"Presenting the IndusInd Bank Pinnacle Credit Card – a card meant for those for whom excellence is not an option but a habit.

Enjoy a luxurious range of unique travel, lifestyle, and golf privileges and say goodbye to the feeling that you’re not getting what you paid for."

Total Savings*

Reward Points**

Sum assured***

Savings on fuel surcharge

Collect and multiply your reward points by using your IndusInd Bank Pinnacle Credit Card anytime and anywhere.

You have earned your reward points and now it’s on you to decide how to redeem them.

Earn big on each spend using your credit card for shopping, booking movie tickets, bill payments and more.

E-commerce transactions |

₹ 100 spent = 2.5 reward points |

E-com travel and airline transactions |

₹ 100 spent = 1.5 reward points |

PoS, MoTo, IVR transactions and Standing instructions |

₹ 100 spent = 1 reward point |

Here are our tailored redemption options that offer maximum benefits:

| IndusMoments | Click here for the terms and conditions |

| Pay with Rewards | Click here for more information and terms & conditions |

| Airline miles on InterMiles | Click here for the terms and conditions |

| Airline miles on Vistara | Click here for the terms and conditions |

| Cash credit | Click here for the terms and conditions |

Click here for generic terms and conditions and to get a step-by-step guide to redeem your reward points against any of the above redemption options.

Please note: From 1st April 2018, fuel transactions will not accumulate reward points on your card.

Please note:From 1st August 2019, the Rewards program will be revised for select merchant categories. Click here for details.

Please note, w.e.f January 3, 2023, Reward Points on Rent payment transactions done through third-party merchants on your IndusInd Bank Pinnacle Credit Card will be capped at 500 in a statement cycle. T n C apply.

Experience bespoke luxury and fascinating holidays as you choose from a bouquet of luxurious Oberoi Hotels.

Our Oberoi gift voucher offers you a memorable stay with your family or friends. To book your holiday, please contact Oberoi Central Reservations (Toll free: 1 800 11 2030; Telephone: +91 11 2389 0606; Email: reservations@oberoigroup.com; Fax: +91 11 2389 0500).

Please note: These welcome gifts are available at select fee points only. Contact our phone banking assistance for any further details.

Click here for terms & conditions

Experience Montblanc, a brand that epitomises craftsmanship and quality par excellence. You can choose from an exquisite collection of watches, stationery, jewellery, leather goods and eyewear from one of the most premium brands in the world.

Click here for T&Cs.

Indulge in a world of extravagance with the Luxe Gift Card – One Card, Several Indulgences. Get access to more than 30 global luxury and premium brands with a presence of over 360 stores across 30 cities in India.

Please Click here for terms and conditions.

A Collection Of Intimate Luxury Hotels Hidden In Holiday Destinations Across India. Combine luxury with simplicity and retreat to a life you've always wanted.

For reservations, please contact: Phone: +91 7999555222 or Email: sales@postcardresorts.com

*Click here for terms and conditions.

With the IndusInd Bank Credit Card you can enjoy various discount vouchers from multiple brands like Amazon, Flipkart, Zee5, Apollo Pharmacy, Uber, Ola and more.

These brands are subject to change at the discretion of the Bank & Vouchagram.

Please note, welcome gift is only applicable on select fee plan.

Click here know the TnC and list of Essential categories available under Vouchagram

You are spoilt for choice! With the IndusInd Bank Credit Card you can enjoy various discount vouchers from multiple brands like Pantaloons, Bata, Raymond, Hush Puppies, and more.

These brands are subject to change at the discretion of the Bank & Vouchagram.

Please note, welcome gift is only applicable on select fee plan.

Click here to know the TnC and list of Brands available under Vouchagram Premium

Our main aim is to make cashless transactions safe and secure for all our customers. Hence, we have introduced ‘Total Protect' - a first-of-its-kind programme that covers you for an amount equal to the credit limit on your card and is also available on add-on cards.

Total Protect covers you for the following:

Counterfeit fraud:

There is a possibility of your card or card details to be stolen and misused to produce counterfeit cards. We offer you insurance to protect you against such incidents.

Click here for T&Cs of the applicable insurance policy.

Air accident cover:

With the IndusInd Bank Pinnacle Credit Card, you also get a complimentary personal air accident insurance cover of up to Rs 25,00,000.

Click here for T&Cs.

Gain exclusive access to some of the most picturesque golf courses and golf clubs in India. As an IndusInd* Bank Pinnacle Credit Card holder, enjoy complimentary golf games and lessons**, specially hosted for you at leading golf clubs.

Click here to book your complimentary Golf Games & Lessons.

*Golf privileges are brought to you by IndusInd Bank in conjunction with Apexlynx.

**Offer is subject to applicable detailed T&Cs.

Complimentary Hole in One Insurance worth Rs.20,000. Please click here for terms and conditions.

For a list of clubs for complimentary green fees and golf lessons, please click here.

BookMyShow

Movie offer:

Sit back and enjoy a lovely movie with your friends and family. As an IndusInd Bank Pinnacle Credit Card holder, enjoy buy one get one free on movie tickets through our booking partner BookMyShow.

Let’s have a look at what’s on offer:

*The price of the free ticket is capped at ₹200. If the price is higher, you will get a ₹200 discount, and the remaining amount must be paid using your IndusInd Bank Pinnacle Credit Card.

Click here for T&Cs.

Our Priority Pass Programme is one such privilege that allows you access to 700+ lounges across the world.

Note: Effective 1st April 2018, you are eligible for TWO complimentary visits in each calendar quarter to any of the participating international lounges outside India.

Click here for the terms and conditions.

Visit https://www.prioritypass.com/en/airport-lounges to find list of lounges available with Priority Pass.

Value Offering

| Annual Membership | Priority Pass | Annual Benefit |

|---|---|---|

| Priority Pass Membership | $99 x 2 | $198 (Approx Rs 9,900) |

Our Travel Plus Programme is designed to enrich your travel experiences and add another level of comfort and luxury to your journeys.

In addition to VIP access at 700+ airport lounges around the world as part of the Priority Pass Programme, you also enjoy special waivers on lounge usage charges outside India with Travel Plus.

Value Offering

| Programme | Travel Insurance | Lounge Usage | Enrolment Fee | Annual Saving |

|---|---|---|---|---|

| Travel Plus | Yes | Maximum of 8 lounge usage/year of value $27 | Rs 5,000 per annum wef 15th Oct 2013 | Rs 12,960 approximately |

While travelling, any sudden or unforeseen event tends to cause a great deal of stress. For example, a missed flight or loss of baggage or passport not only leads to stress but may also result in unplanned expenditure. To avoid this and to ensure a smooth journey, IndusInd Bank has tied up with ICICI Lombard General Insurance Company Limited to provide cardholders with the following insurance coverage:

| Insurance Coverage | Sum assured (up to) |

|---|---|

| Lost baggage | Rs 1,00,000 |

| Delayed baggage | Rs 25,000 |

| Loss of passport | Rs 50,000 |

| Lost ticket | Rs 25,000 |

| Missed connection | Rs 25,000 |

Click here for T&C of the applicable insurance policy

Due to our fast-paced lives, nobody has the time to wait. We understand this and our exclusive Direct Connect service is designed to help you get instant assistance. Just call us on 1860 267 7777 from your registered mobile number, and we will promptly connect you to a phone banking expert who will deliver the required assistance.

You can email us all your queries and concerns at priority.care@indusind.com

The IndusInd Bank Pinnacle Credit Card offers a team of highly efficient professionals, accessible from any corner of the world, to assist you with flight bookings, hotel reservations, and any support required. This is a complimentary service with a host of premium benefits. All you have to do is call for assistance and we will take care of the rest.

The 24x7 concierge service offers you:

Get all the information, recommendations and assistance required before you embark on your trip. The concierge will provide you with all the information about your travel destination, weather, important landmarks, modes of transport, etc.

Leave it to the concierge to handle all your reservations and to make arrangements in the finest of hotels across the world to ensure you have a pleasurable and comfortable stay.

The concierge will make all the necessary flight arrangements to help you reach your desired destination.

Whether it’s your favourite team’s football match in Europe or watching Roger Federer win the Grand Slam at Wimbledon, our concierge can arrange tickets for any sports event around the world.

Are you interested in attending special events such as workshops or seminars by eminent personalities? The concierge will provide you with all the information you need and also make reservations on your behalf (whenever possible).

Need help arranging for a special gift, or want to send flowers to that special someone? We've got you covered. Leave it to the concierge without a worry. Now you can have gifts delivered to anyone, anywhere in the world. Whether it's a Swiss watch or a bottle of French wine, the concierge will ensure that it is delivered at the earliest. To avail any of these services, please call our concierge desk at 1860 267 7777.

We know your vehicle is important for you and we’re here to make sure that your valuable vehicle gets the attention it deserves.

While you’re making memories on a road trip, we don’t want unforeseen incidents to interrupt your journey. Whether it is an unexpected flat tyre, a vehicle breakdown, or any other emergency, there's no reason to worry.

With your IndusInd Bank Pinnacle Credit Card, avail the Auto Assist facility that will provide on the spot assistance and resolve your problem. All you need to do is give us a call. We provide round-the-clock assistance throughout the year.

Auto Assist offers the following services:

In the event that your vehicle breaks down on the road due to any mechanical/electrical failure, Auto Assist will arrange for a mechanic to repair your vehicle at the location.

In case if you run out of fuel in the middle of nowhere, Auto Assist will arrange to deliver fuel (up to five litres) to your location to get you to the nearest fuel station.

If you have a flat tyre, Auto Assist will arrange for a mechanic to come and repair or replace the tyre.

Locked yourself out of your car? Or misplaced/lost your car keys? No reason to worry, Auto Assist can arrange for a locksmith to come and make a new car key or open your car door for you.

Is your car battery dead or malfunctioning? Once again, Auto Assist will come to your rescue. We can arrange for a service provider to come to the spot and fix your battery issue.

In case of a breakdown wherein your car needs to be towed, Auto Assist will arrange for a towing service to tow your car to a garage for repair.

In the event of an accident or emergency, Auto Assist can help you by coordinating important activities such as emergency message transmission, arranging for emergency medical assistance, and towing of vehicle.

Auto Assist services are available in Mumbai, Delhi, Bangalore, Pune, Chennai, and Kolkata.

For further details please call the concierge desk at 1860 267 7777.

Click here for T&Cs of the applicable.

Get freedom from surcharge on fuel across India. Enjoy a waiver* of 1% on fuel surcharge at any fuel station in the country.

*Click here for terms and conditions

A special Priority Pass membership for you and your partner.

2 complimentary golf games and 2 complimentary golf lessons once a month at any of the select prestigious clubs*

Private golf lessons and hole-in-one insurance.

Complimentary movie tickets thrice a month.

Additional savings on fuel surcharge

Annual value of reward points earned on an average spend of ₹ 30,000 per month. (450 points per month)

Eligibility

Your income/ITR should be:

Documentation:

For salaried individuals:

For self-employed individuals:

Note: All the above documents need to be self-attested by the applicant. For any further assistance on credit card documentation, please feel free to reach our helpdesk at 1860 267 7777.

Here’s inviting you to embark upon a luxury travel experience like never before. With your IndusInd Bank Pinnacle MasterCard Credit Card, you get access to domestic and international airport lounges in India that welcome you into a world of exclusivity. Choose from an assortment of gourmet meals, relax and sink into comfortable seating and enjoy free Wi-Fi, widescreen televisions and bar services. What’s more, you get complimentary lounge visits per quarter on your IndusInd Bank Pinnacle MasterCard Credit Card.

Please note: From 1st April 2018 onwards, you can avail 1 complimentary visit every 3 months in any of the participating domestic lounges on your IndusInd Bank Pinnacle Credit Card.

Click here for facilities and list of eligible lounges.

Buy prepaid Forex Cards and reload them as and when needed, buy and sell foreign currency cash and send money abroad.

An IndusInd Bank Fixed (Term) Deposit is a guaranteed-return investment with competitive benefits so that your money can work for you

With IndusInd Bank’s personal loan, you can achieve all your goals. You can effectively turn your dream into reality.

We understand the value of money and have designed an account which gives you the power to save and offers a hassle-free banking experience.

A specialised product for the retail wholesalers, showroom owners and job work industries, service industries, manufacturers , exporters and importers

A first of its kind credit card in the Indian sub-continent that comes with a pure 22K Gold inlay and absolutely no preset spending limit.

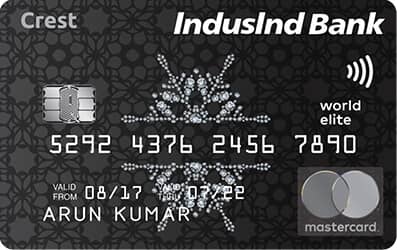

Inspired by your lifestyle, your refined tastes and more, we bring you the uber-exclusive IndusInd Bank Crest Credit Card. It is made with precision, passion, and panache to match your stylish lifestyle.

A credit card that allows you to earn rewards faster and helps you redeem them as per your convenience.