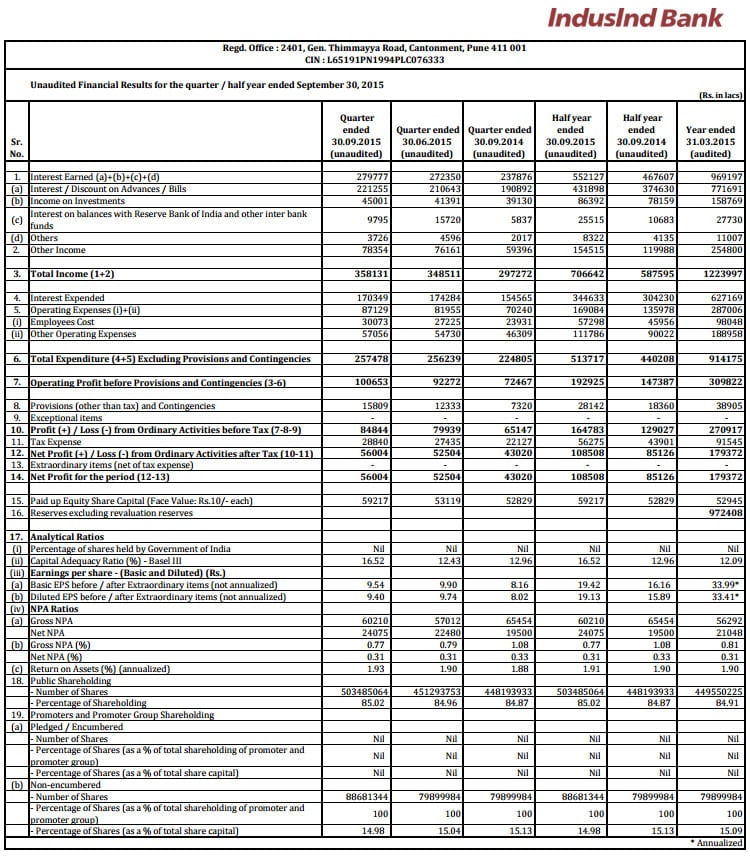

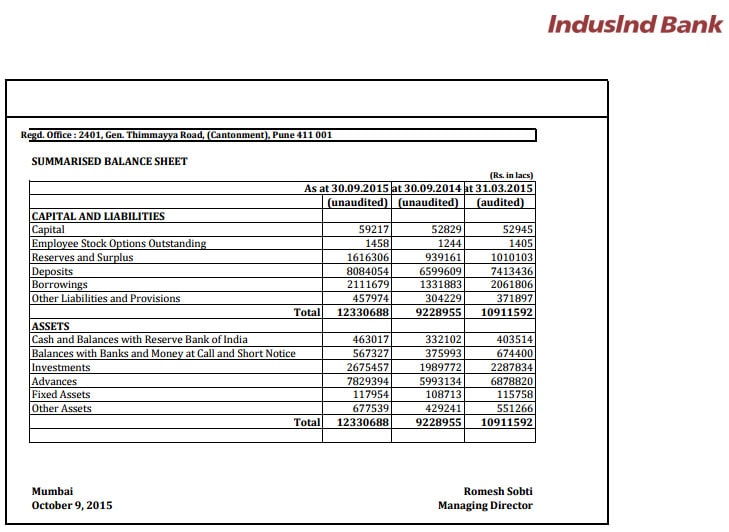

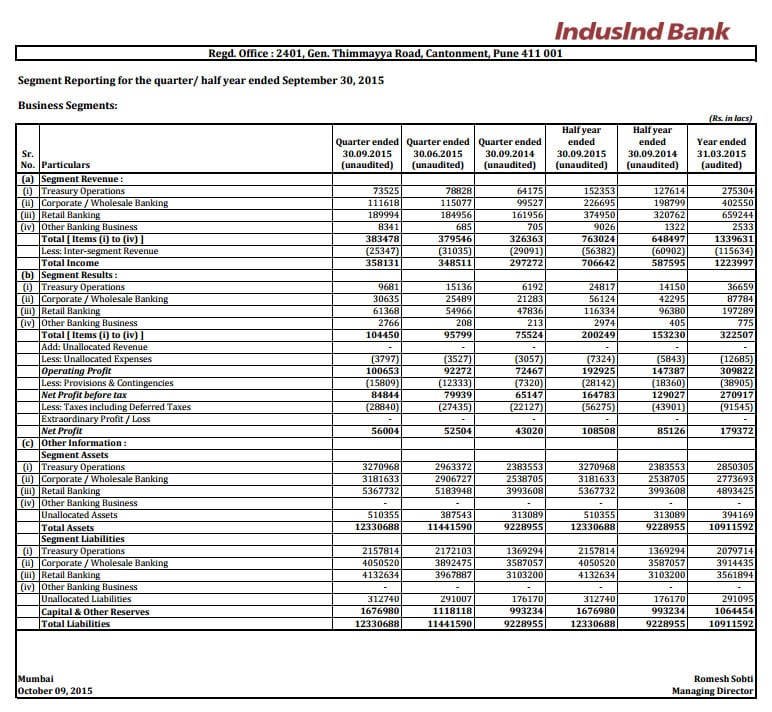

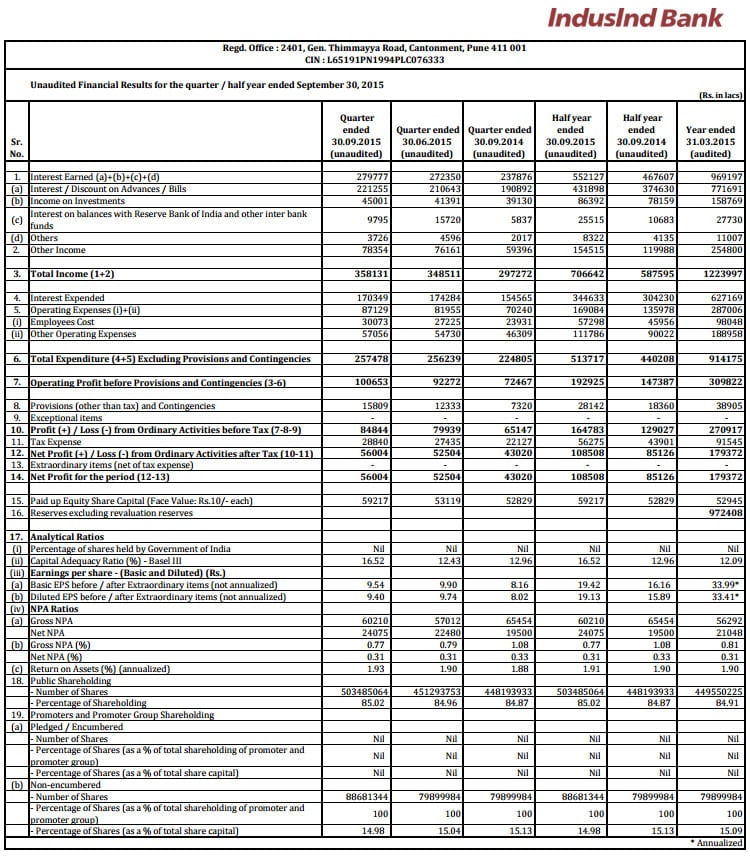

| 1 | There has been no material change in the accounting policies adopted during the quarter and half year ended September 30, 2015 as compared to those followed for the year ended March 31, 2015. | | | | 2 | The working results for the quarter and half year ended September 30, 2015 have been arrived at after considering provision for standard assets including requirements for exposures to entities with Unhedged Foreign Currency Exposures, non-performing assets (NPAs), depreciation on investments, income-tax and other usual and necessary provisions. | | | | 3 | The above financial results for the quarter and half year ended September 30, 2015 were subjected to a Limited Review by the Statutory Auditors of the Bank. A clean report has been issued by them thereon. These financial results were reviewed by the Audit Committee and subsequently have been taken on record and approved by the Board of Directors at its meeting held on October 9, 2015. | | | | 4 | RBI Master Circular DBR.No.BP.BC.1/21.06.201/2015-16 dated July 01, 2015, as amended, on Basel III Capital Regulations contain guidelines on certain Pillar 3 and leverage ratio disclosure requirements that are to be made along with the publication of financial results. Accordingly, such applicable disclosures have been placed on the website of the Bank which can be accessed at the following link: https://www.indusind.com/content/home/important-links/regulatory-disclosures-section.html These disclosures have not been subjected to the Limited Review. | | | | 5 | Pursuant to RBI circular DBR.BP.BC.No.31/21.04.018/2015-16 dated July 16, 2015, the Bank has, with effect from September 30, 2015, included its deposits placed with NABARD, SIDBI and NHB on account of shortfall in lending to priority sector under ‘Other Assets’. Hitherto these were included under ‘Investments’ and interest income thereon was included under ‘Interest Earned-Income on Investments’. Arising out of regrouping in line with above mentioned RBI guidelines, interest income on deposits placed with NABARD, SIDBI and NHB is included under ‘Interest Earned-Others’. Figures for the previous periods have been regrouped / reclassified to conform to current period’s classification. The above change in classification has no impact on the profit of the Bank for the quarter ended September 30, 2015 or the previous periods. | | | | 6 | In terms of RBI circular DBOD.BP.BC.No.98/21.04.132/2013-14 dated February 26, 2014, in respect of assets sold to SC/RCs, during the quarter ended March 31, 2015, the shortfall arrived at by deducting sale consideration and provisions held as on the date of sale from the outstanding amount, is being amortized over two years. Accordingly, the Bank has charged to the Profit and Loss account an amount of Rs. 32.09 crores during the current quarter. | | | | 7 | During the quarter, the Bank completed the acquisition of Diamond and Jewellery financing business from Royal Bank of Scotland N.V. on a slump sales basis. The business takeover was completed on July 24, 2015 and the initial consideration paid towards the acquisition has been allocated to various assets and liabilities including an advance portfolio of Rs. 4,130.40 crores. Pending finalization of the consideration and settlement thereof, the purchase price allocation has been made on a best estimate basis and the final adjustments are not expected to be material. The income generated by the business from that date has been included in the financial results. | | | | 8 | Effective July 01, 2015, the Bank has regrouped sourcing costs relating to small ticket retail loan origination and bank charges incurred by the Consumer Finance Division under “Operating Expenses†which were hitherto netted off from ‘Other income’ in order to be aligned with practice followed by the industry. Figures for the previous periods have been regrouped / reclassified accordingly. This change in classification has no impact on the profit of the Bank for the quarter ended September 30, 2015 or the previous periods. | | | | 9 | On July 03, 2015, the Bank allotted 5,12,18,640 equity shares of Rs. 10/- each at a price of Rs. 845.00 per share, aggregating to Rs. 4,327.98 crores through a Qualified Institutions Placement (QIP). On August 06, 2015, the Bank also allotted to the promoters 87,81,360 equity shares of Rs. 10/- each at a price of Rs. 857.20 per share, aggregating to Rs. 752.74 crores through a Preferential Allotment. Pursuant to these allotments, the share premium account stands increased by Rs. 4,970.04 crores net of share issue expenses of Rs. 50.67 crores. | | | | 10 | During the quarter and half year ended September 30, 2015, the Bank allotted 9,72,671 shares and 27,16,199 shares respectively, pursuant to the exercise of stock options by certain employees. | | | | 11 | Marked to market position on derivatives is shown on a net basis in the Summarised Balance Sheet. Had this been shown on a gross basis, the balance sheet for three dates would have been higher by Rs. 2,572.06 crores, Rs. 2,204.53 crores and Rs. 2,243.09 crores respectively. | | | | 12 | The position of investor complaints is as under: No. of complaints pending resolution at the beginning of the quarter Nil ; received during the quarter 29; resolved during the quarter 29; closing position Nil. | | | | 13 | Previous period / year figures have been regrouped / reclassified, where necessary to conform to current period / year classification. | | |

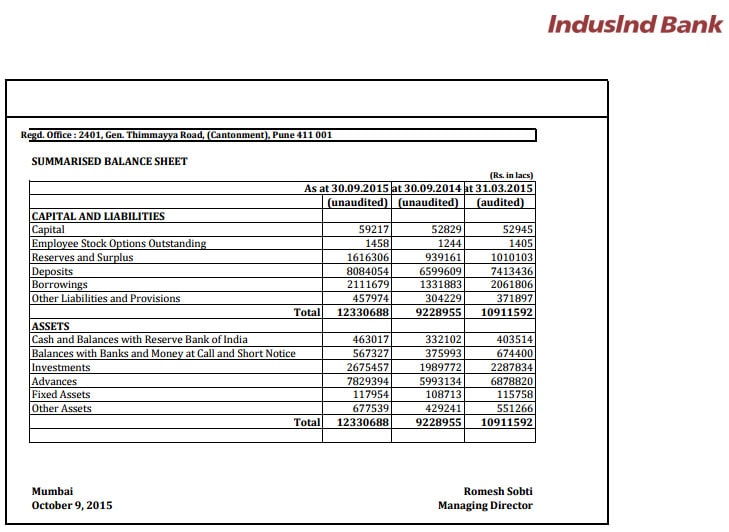

|