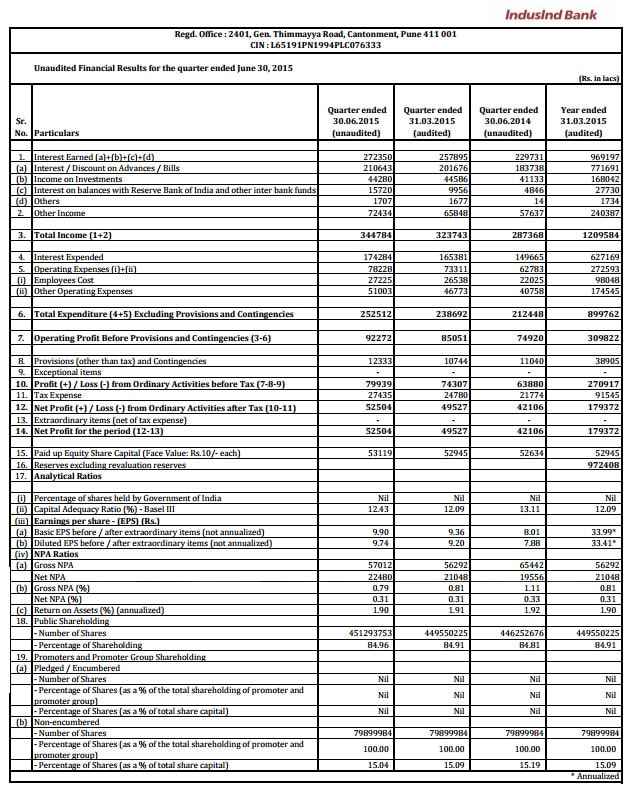

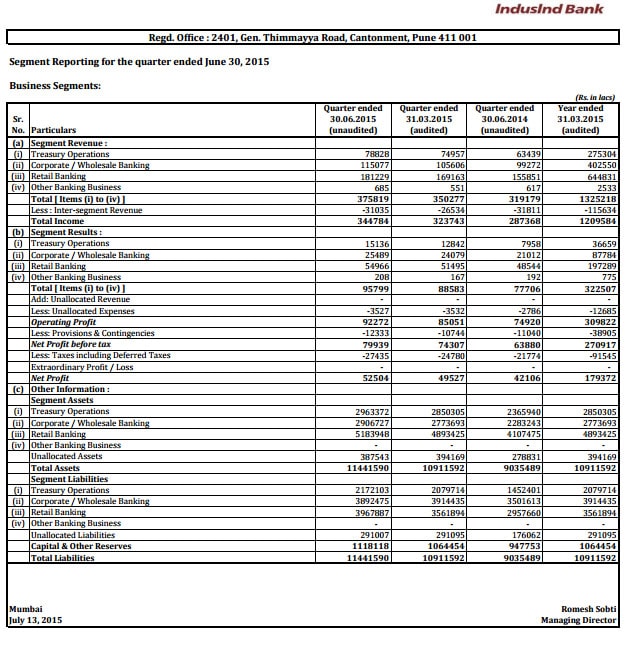

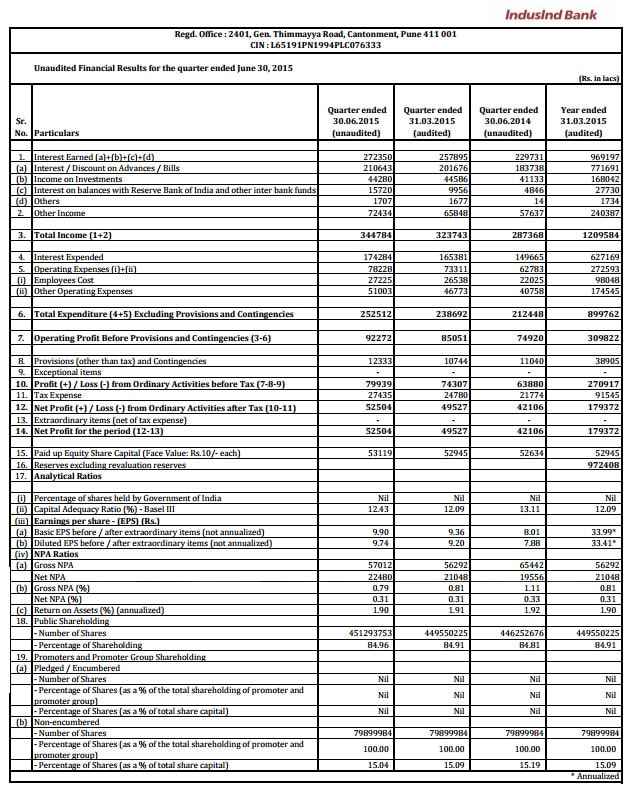

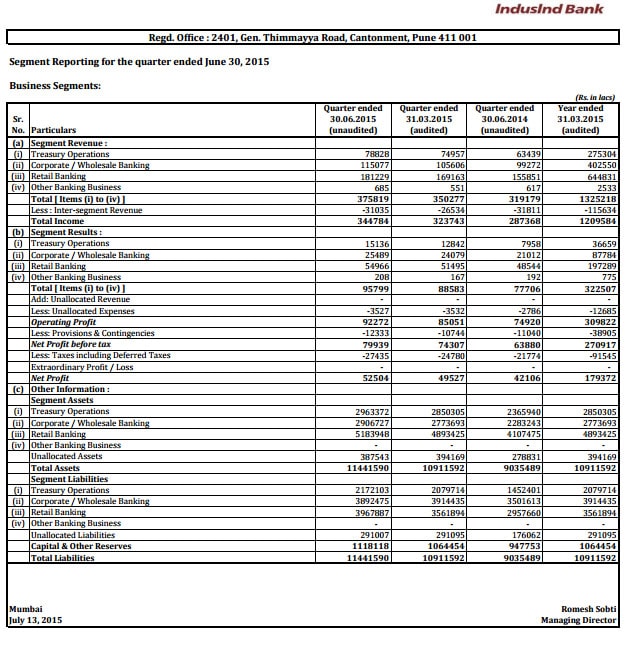

| 1 | There has been no material change in the accounting policies adopted during the quarter ended June 30, 2015 as compared to those followed for the year ended March 31, 2015. | | | | 2 | The working results for the quarter ended June 30, 2015 have been arrived at after considering provision for standard assets, non-performing assets (NPAs), depreciation on investments, income-tax and other usual and necessary provisions. | | | | 3 | The above financial results for the quarter ended June 30, 2015 were subjected to a “Limited Review” by the Statutory Auditors of the Bank. A clean report has been issued by them thereon. These financial results were reviewed by the Audit Committee and subsequently have been taken on record and approved by the Board of Directors at its meeting held on July 13, 2015. | | | | 4 | RBI master circular DBOD.No.BP.BC.6/21.06.201/2014-15 dated July 01, 2014, as amended, on Basel III Capital Regulations and in terms of RBI circular DBR.No.BP.BC.58/21.06.201/2014-15 dated January 8, 2015 on revised framework for leverage ratio contains guidelines on certain Pillar 3 and leverage ratio disclosure requirements that are to be made along with the publication of financial results. Accordingly, such applicable disclosures have been placed on the website of the Bank which can be accessed at the following link: https://www.indusind.com/content/home/important-links/regulatory-disclosures-section.html These disclosures have not been subjected to the “Limited Reviewâ€. | | | | 5 | In terms of RBI circular number DBOD.BP.BC.No.98/21.04.132/2013-14 dated February 26, 2014, in respect of assets sold to SC/RCs, during the quarter ended March 31, 2015, the shortfall arrived at by deducting sale consideration and provisions held as on the date of sale from the outstanding amount, is being amortized over two years. Accordingly, the Bank has charged to the Profit and Loss account an amount of Rs.32.09 crores during the current quarter. | | | | 6 | During the quarter ended June 30, 2015, the Bank allotted 17,43,528 shares pursuant to the exercise of stock options by certain employees. | | | | 7 | The position of investor complaints is as under: No. of complaints pending resolution at the beginning of the quarter NIL; received during the quarter 48; resolved during the quarter 48; closing position NIL. | | | | 8 | On April 10, 2015, the Bank entered into an agreement with Royal Bank of Scotland N.V. to acquire on a ‘slump sale’ basis its Diamond and Jewellery financing business of approximately Rs. 4,500 crores in size and related deposit portfolio subject to certain regulatory approvals. The process of taking over of the business is under way. On completion of the formalities related to the transaction, the advances and related deposit portfolio of the Bank will increase to the extent of acquisition. | | | | 9 | The Bank allotted 5,12,18,640 equity shares of Rs. 10/- each at a price of Rs. 845.00 per share, aggregating to Rs. 4,327.98 crores on July 3, 2015 through a Qualified Institutions Placement (QIP). | | | | 10 | The Bank has sought approval of shareholders through postal ballot vide notice dated June 25, 2015 for preferential allotment of 87,81,360 equity shares to promoters of the Bank in compliance with Chapter VII of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations 2009, as amended, the results of which will be announced on July 30, 2015. | | | | 11 | Previous period figures have been regrouped / reclassified, where necessary to conform to current period classification. | | |

|