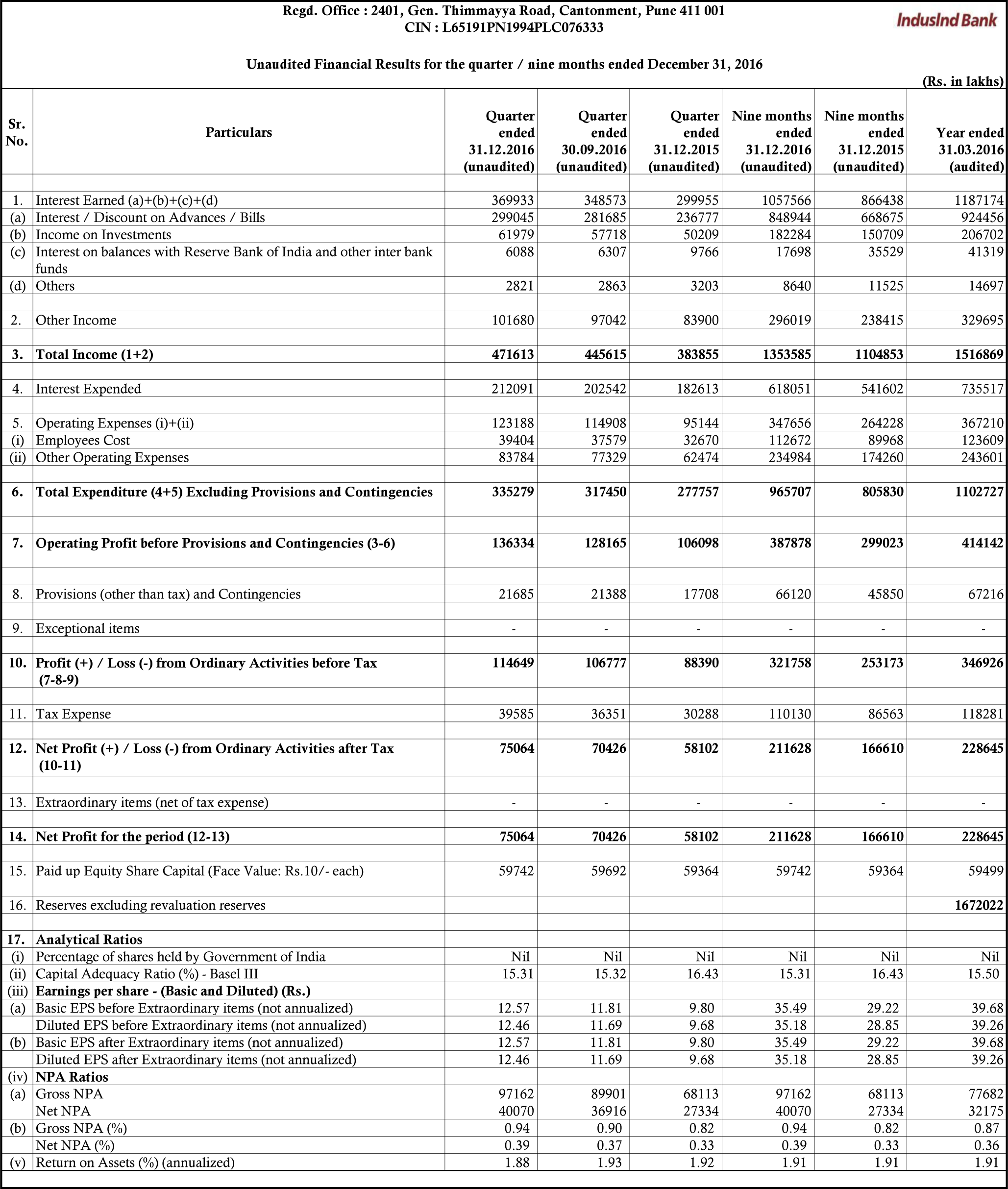

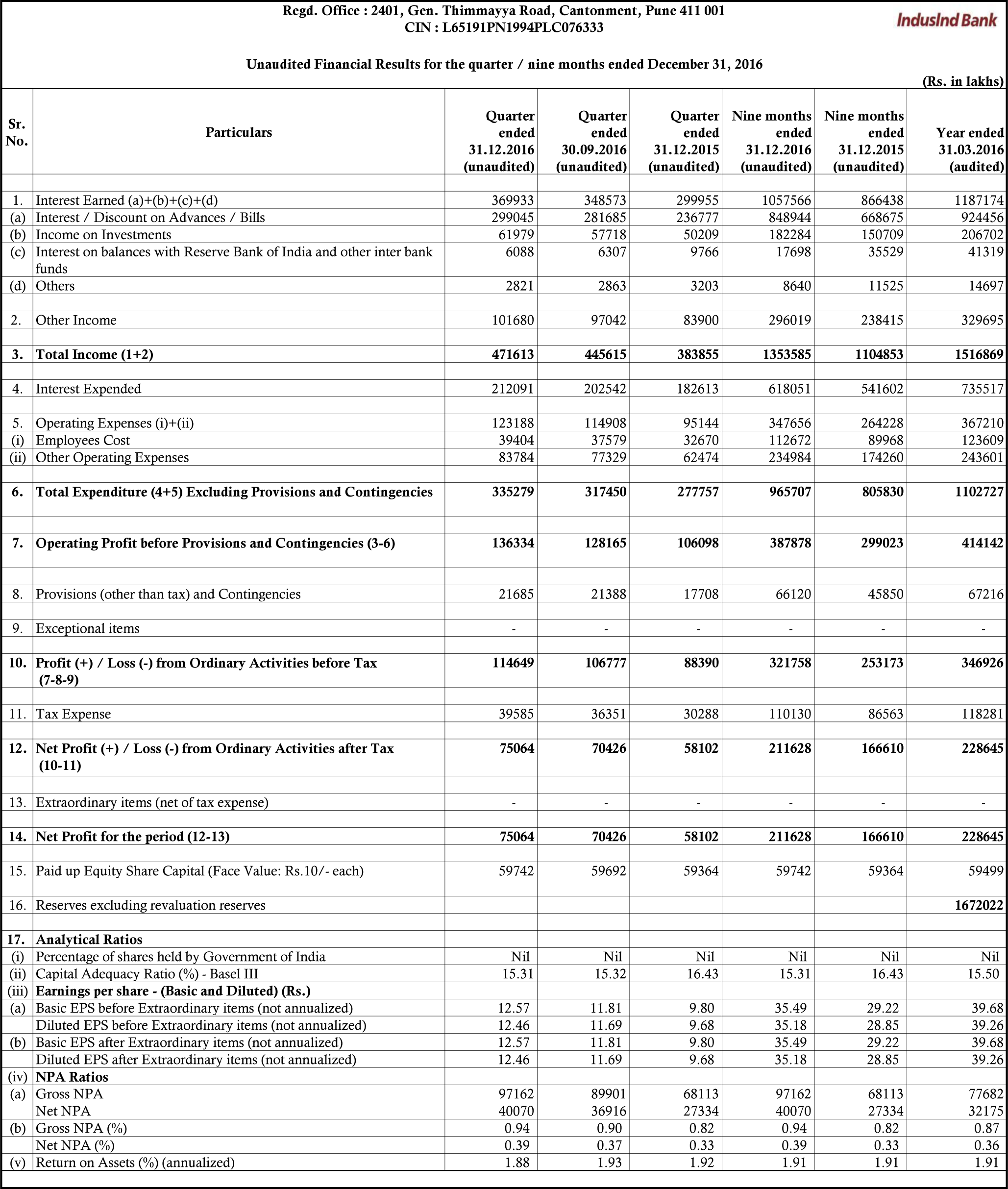

| 1 | There has been no material change in the accounting policies adopted during the quarter / nine months ended December 31, 2016 as compared to those followed for the year ended March 31, 2016. |

| |

| 2 | The working results for the quarter / nine months ended December 31, 2016 have been arrived at after considering provision for standard assets, including requirements for exposures to entities with Unhedged Foreign Currency Exposure, non-performing assets (NPAs), depreciation on investments, income-tax and other usual and necessary provisions. |

| |

| 3 | The above financial results for the quarter / nine months ended December 31, 2016 were subjected to a “Limited Review” by the Statutory Auditors of the Bank. A clean report has been issued by them thereon. These financial results were reviewed by the Audit Committee and subsequently have been taken on record and

approved by the Board of Directors at its meeting held on January 10, 2017. |

| |

| 4 | RBI Master Circular DBR.No.BP.BC.1/21.06.201/2015-16 dated July 01, 2015, as amended, on Basel III Capital Regulations contain guidelines on certain Pillar 3 and leverage ratio disclosure requirements that are to be made along with the publication of financial results. Accordingly, such applicable disclosures have been placed on the website of the Bank which can be accessed at the following link: https://www.indusind.com/content/home/important-links/regulatory-disclosures-section.html These disclosures have not been subjected to the Limited Review. |

| |

| 5 | The Capital Adequacy Ratio is computed on the basis of RBI guidelines applicable on the relevant reporting dates and the ratio for the corresponding previous period is not adjusted to consider the impact of subsequent changes if any, in the guidelines. |

| |

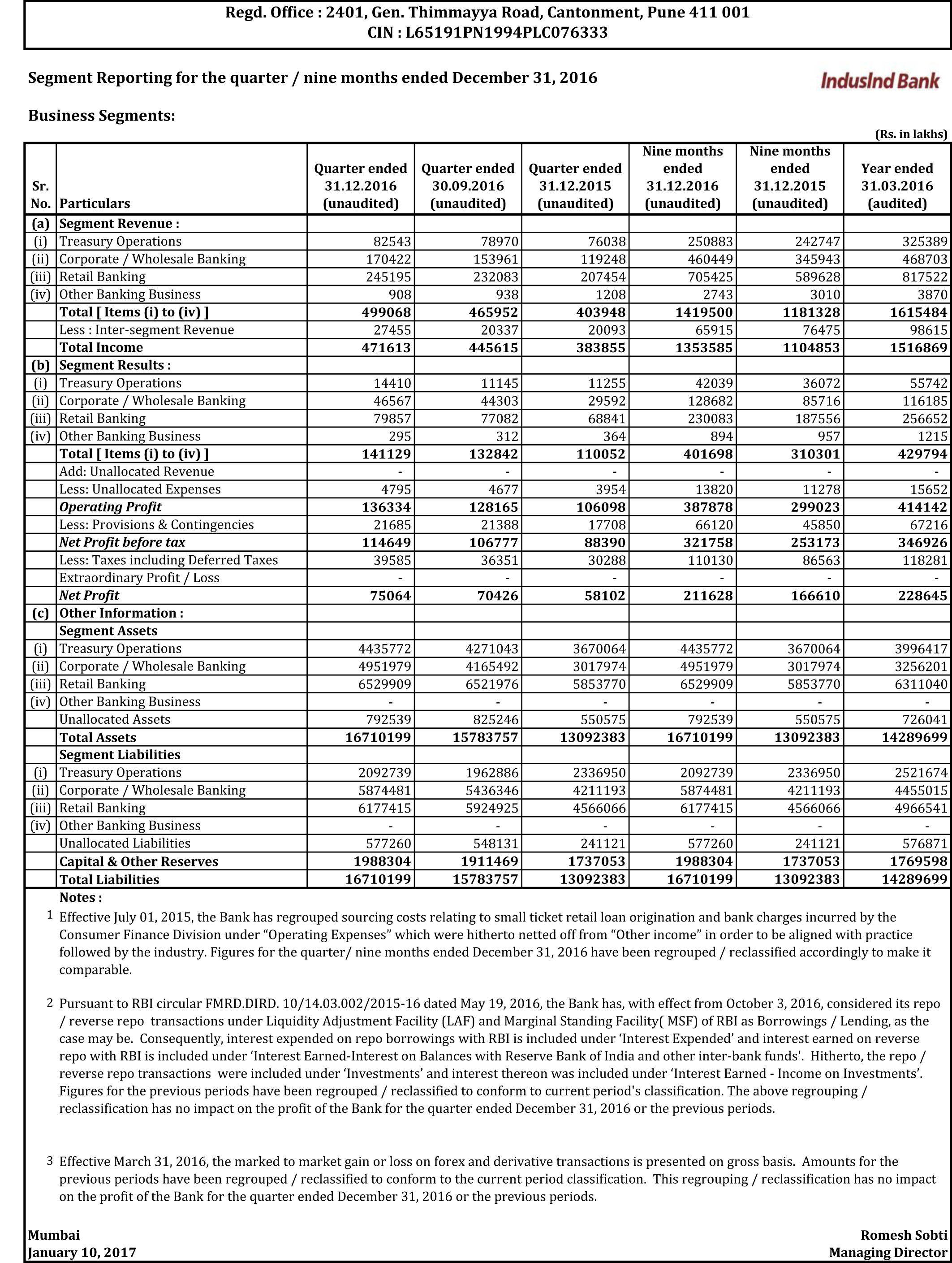

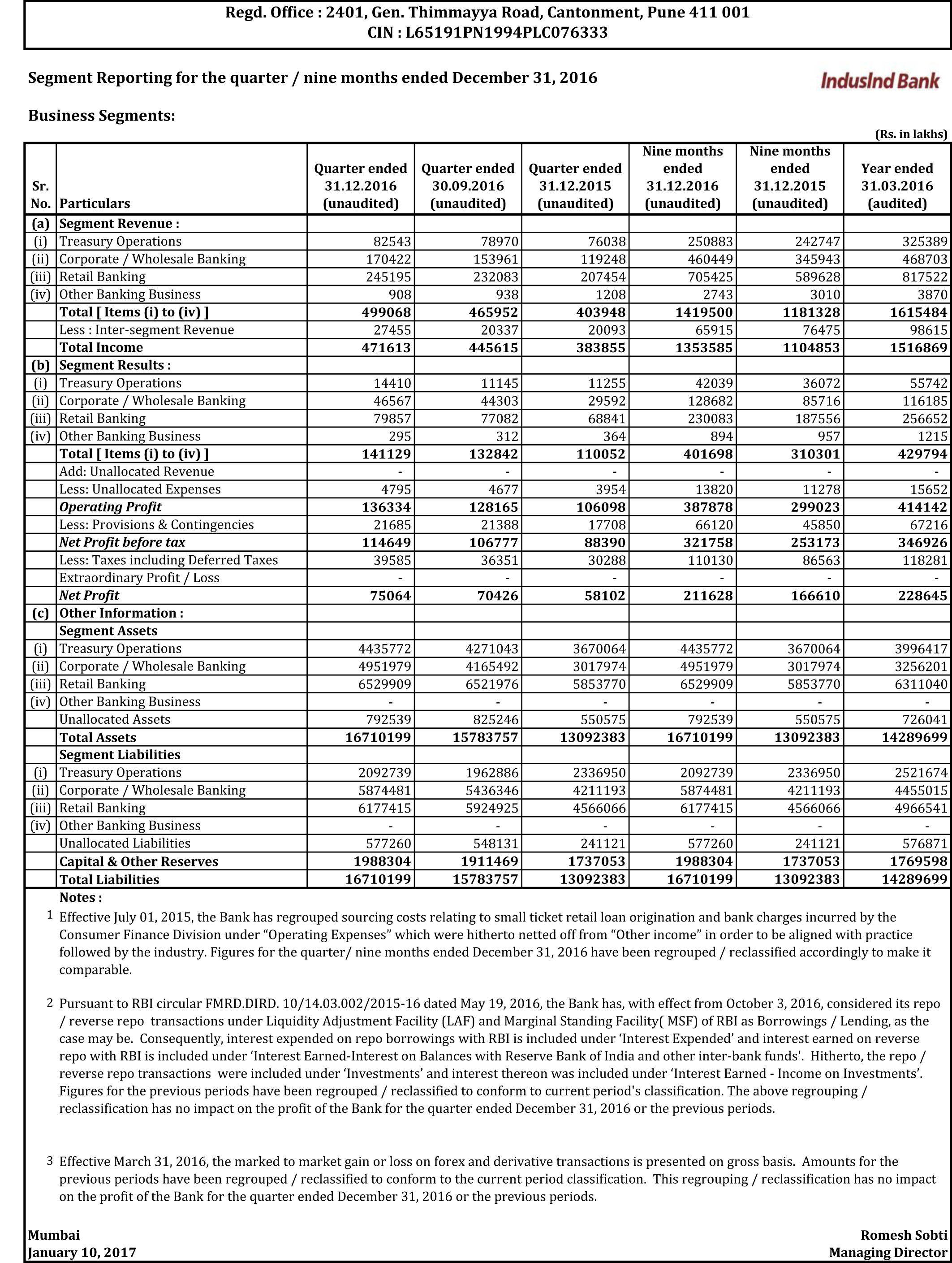

| 6 | The business operations of the Bank are largely concentrated in India and for the purpose of Segment Reporting, the Bank is considered to operate only in domestic segment. On obtaining RBI approval, the Bank has commenced during the quarter ended June 30, 2016, its operation in International Finance Service Centre (IFSC)Â Banking Unit in Gujarat International Finance Tec City (GIFT). The business conducted from the same is considered as a part of Indian operations. |

| |

| 7 | Pursuant to RBI circular FMRD.DIRD. 10/14.03.002/2015-16 dated May 19, 2016, the Bank has, with effect from October 3, 2016, considered its repo / reverse repo transactions under Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF) of RBI as Borrowings / Lending, as the case may be. Consequently, interest expended on repo borrowings with RBI is included under ‘Interest Expended’ and interest earned on reverse repo with RBI is included under ‘Interest EarnedInterest

on Balances with Reserve Bank of India and other inter-bank funds’. Hitherto, the repo / reverse repo transactions were included under ‘Investments’ and interest thereon was included under ‘Interest Earned – Income on Investments’. Figures for the previous periods have been regrouped / reclassified to conform to current period’s classification. The above regrouping / reclassification has no impact on the profit of the Bank for the quarter ended December 31, 2016 or the previous periods. |

| |

| 8 | In terms of RBI circular DBOD.BP.BC.No.98/21.04.132/2013-14 dated February 26, 2014, in respect of assets sold to SC/RCs during the quarter ended March 31, 2015 , the shortfall arrived at by deducting sale consideration and provisions held as on the date of sale from the outstanding amount, is being amortized over two

years. Accordingly, the Bank has charged to the Profit and Loss account an amount of Rs. 32.09 crores during the current quarter. |

| |

| 9 | During the quarter / nine months ended December 31, 2016, the Bank allotted 507738 shares and 2437523 shares respectively, pursuant to the exercise of stock options by certain employees. |

| |

| 10 | The position of investor complaints is as under:

No. of complaints pending resolution at the beginning of the quarter 2; received during the quarter 44 ; resolved during the quarter 45 ; closing position 1. |

| |

| 11 | Previous period / year figures have been regrouped / reclassified, where necessary to conform to current period / year classification. |

| |