Trading, Demat & Savings- All in One

Overview

Enjoy the convenience of Savings, Trading and DEMAT with Indus 3-in-1 account. Your Savings and trading account will be seamlessly integrated to enable you to trade conveniently.

Attractive offers on your debit card

Balance Non-Maintenance Charges waiver

Rs.1000 Worth Annual Reward Points*

Key Features & Benefits

Seamlessly integrate your IndusInd Bank Savings Account and Motilal Oswal DEMAT and Trading account to transfer the funds.

| Benefits | Saving Worth |

|---|---|

| Reward Points on shopping on Titanium Debit Card | 1000 |

| Total Annual Discount on Swiggy | 7200 |

| Total Annual Discount on bigbasket.com | 2400 |

| TOTAL SAVINGS WORTH | 10600 |

Delightful Deals:

Use your IndusInd Bank Debit Card & Get up to 20% off on Swiggy and up to Rs. 200/- off on Big Basket. Know More

Reward Points on all your spends :

Earn rewards on shopping with your Debit Card. Redeem these reward points for Cashback. Know more

Dining Delights :

Enjoy upto 15% off on the best of restaurants in your city Know More.

Best of Deals :

Fabulous offers on Travel, Fashion & Shopping Know More.

Hassle Free Trading

Open your Trading & DEMAT account with our alliance partner Motilal Oswal Financial Services hassle free

Complimentary Insurance

Enjoy complimentary Insurance cover worth Rs. 1.5L with your Titanium/Gold Debit Card. Know more.

- DEMAT AMC waiver for 2 years

- Flat 10% Discount on all special value added packs

- Dedicated relationship manager from Motilal Team for advisory support

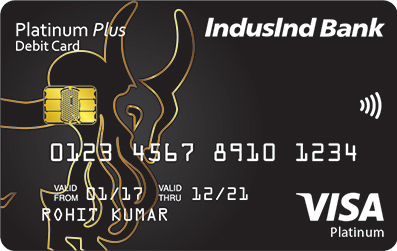

Recommended Debit Card

Titanium Debit Card

Rs 1,000 worth Annual Reward Points*

Account Dependent Issuance/Annual Fee

Rs 50,000 ATM Limits

Rs 1,00,000 POS (Point-of-Sale) Limits

*on monthly spends of Rs 35,000/-

Indus 3-in-1 Fees & Charges

When you sign up for our Savings Account, certain fees and charges may be applicable. These charges are nominal, transparent and disclosed by IndusInd Bank upfront so that you know what you are paying or being charged for.

Please click here to see the detailed Schedule of Charges for the account variant.

Please click here for Savings Account T&C.

FAQs

Is there any balance maintenance requirement in Indus 3 in 1 Savings Account?

Indus 3 in 1 account is specially curated for trading purpose. To have seamless transfer of funds and trading experience, non-maintenance charges are waived of if you link your MOSL trading account with Indus 3 in 1 account

What is DEMAT & Trading account?

A DEMAT account is where shares and securities are held electronically. The DEMAT account is used as a bank account where shares bought are bought in, and where shares sold are taken from. A trading account is used to place buy or sell orders in the stock market

How to Open a DEMAT & Trading account with MOSL?

Once your Indus 3 in 1 account is open you will receive an SMS link to open your MOSL DEMAT & Trading account digitally in simple steps

Is there any charges after opening DEMAT & Trading account?

Annual maintenance charges for first two years will be waived off on your DEMAT account. You will be offered competitive brokerage rates on trading.

What is the additional benefit I will get with Indus 3 in 1 Account?

Apart from your Savings account benefits you will have access to reports with in depth analysis of stocks and dedicated advisory support from Motilal Oswal Financial Services, our trading and broking partner