Rewards

1.5 reward points for every ₹ 150 spent

NetBanking

NetBanking

Indus Direct

INDIE for Business

Indie Business

Credit Card

Forex Card

Quick Links

Quick Links

Quick Links

Quick Links

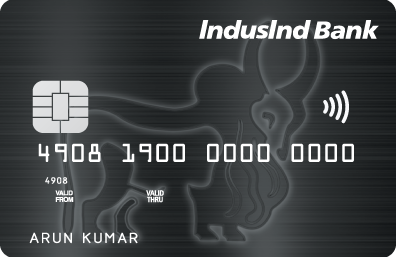

The IndusInd Bank Platinum Master Credit Card offers a comprehensive range of travel and lifestyle benefits to suit your preferences.

1.5 reward points for every ₹ 150 spent

Comprehensive insurance benefits

Fuel surcharge waiver

From 1st March 2024, the value of non-cash redemption (excluding airmiles) will be 1 RP = Rs.0.60

From 1st March 2024, the value of cash redemption will be 1 RP = Rs.0.40

Effective 1st September 2024, maximum reward points allowed for cash redemption will be 2500 per calendar month

For every INR 150 spent on your IndusIndBank Platinum Credit Card , get 1.5 Reward Points.

Avail a plethora of exclusive benefits from the Rewards Program on your IndusInd Bank Platinum Credit Card! Specially designed to suit your lifestyle, it enables you to enjoy the power and freedom of maximum flexibility, access without restrictions and limitations imposed by other programs.

Earning of Reward Points:

It’s in your hands, so take charge! Watch your reward points multiply by using your IndusInd Bank Platinum Credit Card for business or pleasure wherever and whenever you choose!

For every INR 150 spent on your IndusInd Bank Platinum Credit Card, you get 1.5 Reward Points.

#Please note effective from 1st April 2018, fuel transactions will not accrue reward points on your IndusInd Bank Credit Card.

Please note: From 1st August 2019, the Rewards program will be revised for select merchant categories. Click here for details.

We deeply value your need for choice and have tailored our redemption options to offer maximum benefit:

| IndusMoments* | Click here for terms and conditions |

| Pay with Rewards | Click here for more information and terms & conditions |

| Airline Miles on Krisflyer | Click here for terms and conditions |

| *Cash credit New | Click here for terms and conditions |

Click here for generic terms and conditions and steps to redeem your reward points against any of the Redemption options.

Please note: *From 1st January,2024, the value of non cash redemptions (excluding airmiles) will be 1 RP = Rs.0.50

Important Notice: Reward Points Redemption towards Club Vistara Airmiles on www.indusmoments.com for your IndusInd Bank Credit Card will be discontinued effective 31st Oct 2024.

Important Notice: Reward Points redemption towards InterMiles for your IndusInd Bank Credit Card will be discontinued effective 21st January, 2025.

The IndusInd Bank Platinum Credit Card offers you an exclusive lifestyle you richly deserve! Allow us to serve you with world class privileges on your travel, dining and shopping experiences. Handpicked to offer convenience, these super luxury brands are aimed at creating an experience of a lifetime, and are available to you at your convenience.

Experience Montblanc- a brand with the commitment to excellence and fine craftsmanship since 1906. Choose from an exquisite collection of watches, writing instruments, jewellery, leather goods and eyewear.

Mont Blanc stores now are located in 6 cities and we have 12 stores across the country.

click here for terms and conditions.

Please note, welcome gift is only applicable on select fee plan.

A Collection Of Intimate Luxury Hotels Hidden In Holiday Destinations Across India. Combine luxury with simplicity and retreat to a life you've always wanted.

For reservations, please contact: Phone: +91 7999555222 or Email: sales@postcardresorts.com

*Click here for terms and conditions.

Please note, welcome gift is only applicable on select fee plan.

With the IndusInd Bank Credit Card you can enjoy various discount vouchers from multiple brands like Amazon, Flipkart, Zee5, Apollo Pharmacy, Uber, Ola and more.

These brands are subject to change at the discretion of the Bank & Vouchagram.

Please note, welcome gift is only applicable on select fee plan.

Click here know the TnC and list of Essential categories available under Vouchagram

You are spoilt for choice! With the IndusInd Bank Credit Card you can enjoy various discount vouchers from multiple brands like Pantaloons, Bata, Raymond, Hush Puppies, and more.

These brands are subject to change at the discretion of the Bank & Vouchagram.

Please note, welcome gift is only applicable on select fee plan.

Click here to know the TnC and list of Brands available under Vouchagram Premium

Travel Insurance Cover Details

Travel insurance is a priority document for all your trips. IndusInd Bank has tied up with The Oriental Insurance Company Ltd. (‘Insurance Company’) as a group manager to provide cardholders with the following insurance cover under its program:

| Insurance Cover | Sum Assured (up to) |

|---|---|

| Lost baggage | INR 1,00,000 |

| Delayed baggage | INR 25,000 |

| Loss of passport | INR 50,000 |

| Lost ticket | INR 25,000 |

| Missed connection | INR 25,000 |

Click here for terms and conditions

Avail freedom from surcharge on petrol at petrol pumps across India. Enjoy a waiver* of 1% on fuel surcharge at any petrol pump within India.

Value Offering

| Petrol Surcharge Waiver | Monthly Savings | Annual Savings |

|---|---|---|

| Monthly fuel usage @ Rs 2000 | Rs 20 | Rs 240 |

The information given in the value offering is based on certain assumptions and is for illustration purposes only. Actual savings will depend on the usage pattern of the individual cardholder.

Click here for terms and conditions

Total Protect

Has your card fallen into wrong hands? Attempted fraudulent usage of your card can no more pose a threat! Total Protect is a first-of-its-kind program that covers you for a sum up to the credit limit on your credit card and is available on add-on cards as well. With us, you can be completely worry-free about any fraudulent transactions performed using your card.

Total Protect covers you for the following:

*Click here for terms and conditions of the applicable insurance policy.

Air Accident Coverage

With the IndusInd Bank Platinum Credit Card, you also get a complimentary personal air accident insurance cover of up to INR 25 lakh.

It’s time to leave your worries behind. With IndusInd Bank Credit Card Services having your back, you can live your life in cruise-control mode. So sit back and enjoy the ride!

*Click here for terms and conditions of the applicable insurance policy.

Avail of a plethora of exclusive benefits from the Rewards Program on your IndusInd Bank Platinum Credit Card! Specially designed to suit your lifestyle, it enables you to enjoy the power and freedom of maximum flexibility, access without restrictions and limitations imposed by other programs.

Buy prepaid Forex Cards and reload them as and when needed, buy and sell foreign currency cash and send money abroad.

An IndusInd Bank Fixed (Term) Deposit is a guaranteed-return investment with competitive benefits so that your money can work for you

With IndusInd Bank’s personal loan, you can achieve all your goals. You can effectively turn your dream into reality.

Discover the Indus Care Savings Account, crafted to support your financial well-being with exclusive wellness benefits. Secure your future with an account that truly cares for you.

A specialised product for the retail wholesalers, showroom owners and job work industries, service industries, manufacturers , exporters and importers

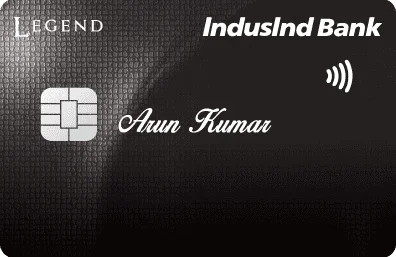

With a unique contactless feature and a card design that enables you to make fast, convenient and secure everyday purchases, the Legend Visa Credit Card helps you earn more reward points on your weekend spends as well as Bonus points on your yearly spends!

Indulge in a world of luxury with the Iconia Credit Card from IndusInd Bank. We excel at serving you and offer you special privileges no other lifestyle credit card can match. All our programs are carefully structured by experts to present you with best-in-class benefits and services. You can experience the elaborate rewards structure doubling your rewards much sooner. Whether you like travelling to new destinations, or if your indulgence is playing a round or two at the finest golf courses, our lifestyle credit card will surely elevate your experience.

"You’ve earned the fame, the prestige and the success. It’s now time to celebrate it with the finer things in life – privileges that are as unique as your charm, and benefits that are as exciting as every new day. With the IndusInd Bank Signature Credit Card, you can enjoy the best-in-class privileges in travel, lifestyle, dining, golf, and more. Because a signature is often the beginning of something amazing; the start of a new success story."

Loan Against Property

Loan Against Property Home Loan

Home Loan