Monthly Archives: April 2024

In the competitive landscape of credit cards, finding the right one that aligns with your lifestyle and financial goals can be a daunting task. However, when it comes to exceptional value, rewards, and benefits, the IndusInd Bank Platinum RuPay Credit Card stands out as a top contender. In this blog, we’ll explore what sets the…

With the rise of digital payment methods, consumers now have more choices than ever when it comes to making transactions. One such option that has gained popularity is Unified Payments Interface (UPI), which offers a seamless and secure way to pay for goods and services, especially groceries. In this blog, we’ll explore the convenience of…

Generation Z, born roughly between the mid-1990s and early 2010s, is stepping into adulthood in an era defined by rapid technological advancements and evolving financial landscapes. As this dynamic generation begins to navigate the complexities of financial independence, one crucial aspect to consider is building and maintaining a stellar credit score. In this blog, we’ll…

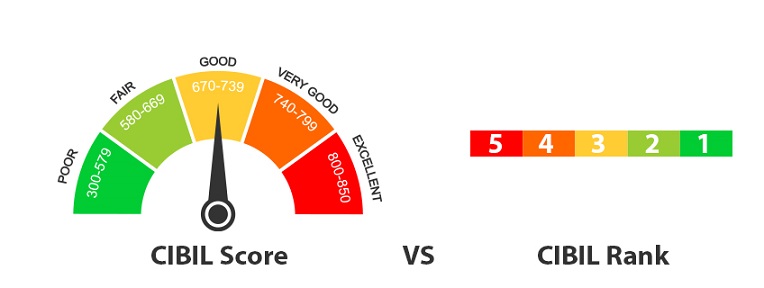

In the world of credit, terms like CIBIL score and CIBIL rank are often used widely amongst the lending industry, leading to confusion among consumers. However, these two metrics serve different purposes and offer unique insights into creditworthiness. In this blog, we’ll explore the contrast between CIBIL score and CIBIL rank, and how understanding these…

Millennials, often referred to as the generation born between the early 1980s and mid-1990s, have been reshaping the economic landscape with their unique financial behaviors and preferences. From their approach to saving and investing to their attitudes towards credit and debt, millennials’ financial habits are a topic of interest and scrutiny. In this blog, we…

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release