What is a Post Dated Cheque? Meaning, Uses, and How to Write One

Posted on Tuesday, May 27th, 2025 | By IndusInd Bank

Ever handed someone a cheque and told them “Please don’t deposit it until next week”? If yes, you’ve already used something called a Post Dated Cheque—even if you didn’t know the term back then.

In India, post dated cheques are still widely used, especially for things like paying rent, EMIs, or making business payments. Whether you’re new to this or just want to understand it better, this blog will walk you through the post dated cheque meaning, how to write one, and what you should keep in mind to avoid legal or financial hiccups.

What is a Post Dated Cheque?

Let’s start with the basics: A post dated cheque (PDC) is a cheque written with a future date on it. This means the person receiving it can’t cash or deposit it until the date mentioned on the cheque.

Example:

Say today is 1st May, but you write a cheque dated 15th May. That cheque becomes a post dated cheque—and the bank won’t process it until the 15th.

So, when we talk about what is post dated cheque, it simply refers to a cheque with a date after the day it’s issued.

Also Read: How to Deposit a Cheque?

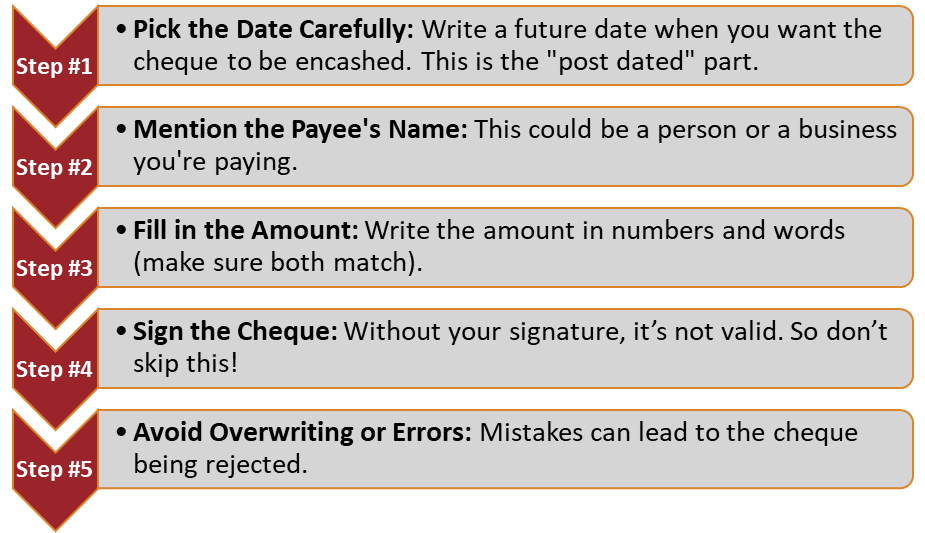

How to Write a Post Dated Cheque (The Right Way)

Writing a post dated cheque is no different from writing a regular cheque—except for one key thing: the date. Here’s a quick step-by-step guide:

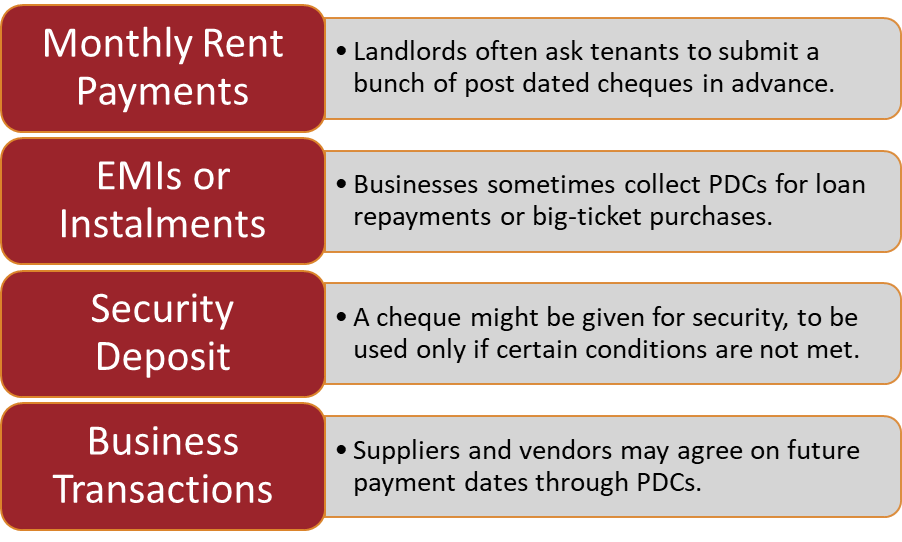

Reasons People Use Post Dated Cheques in India

Wondering why someone would use a PD cheque instead of just paying online or in cash? Here are a few common situations:

Think of a post dated cheque as a promise to pay, just not today.

What is the Validity of a Post Dated Cheque?

Good question! In India, cheques are valid for three months from the date written on them.

For example:

If your cheque says 15 May 2025, it’ll be valid till 14 August 2025. After that, it becomes stale, and the bank won’t process it.

So, whether you’re writing or receiving one, remember that the countdown starts from the future date on the cheque—not the day it’s issued.

Also Read: What is Cheque Bounce? How to Deal with Cheque Bounce?

Legal Consequences of Bouncing a Post Dated Cheque

Here’s where it gets serious.

If you issue a post dated cheque and it bounces due to insufficient funds, you could be in trouble as per the Negotiable Instruments Act. It’s considered a criminal offence in India.

The payee (person who received the cheque) can:

- Send you a legal notice within 30 days of the cheque bouncing.

- File a case if you don’t settle the payment within 15 days of that notice.

And yes, this could mean court visits, fines, or even jail time in extreme cases. So, if you’re issuing a post dated cheque, make sure you have the funds in your account by the due date.

Wrapping Up!

Now that you know what post dated cheques are, how they work, and why they matter—here’s the takeaway: a post dated cheque is not just a piece of paper. It’s a financial commitment.

It might feel old-school in the age of UPI and net banking, but PD cheques still hold their ground in many Indian transactions. So next time you’re asked to write one, or you’re receiving one from someone else, you’ll know exactly what to do (and what to avoid).

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release