Digital Banking Frauds and its Types

Posted on Tuesday, March 11th, 2025 | By IndusInd Bank

Picture this – you are sipping your morning chai, scrolling through your phone, when a message pops up: “Dear Customer, your account will be suspended if you do not update your PAN. Click here to verify.”

Sounds urgent, right? Many people, especially those in a rush, would click the link without thinking twice. And just like that, you could become the latest victim of a digital banking fraud.

Unfortunately, stories like this are becoming all too common in India. The “Report on Trends and Progress of Banking in India 2023-24″ published by the RBI disclosed some shocking data.

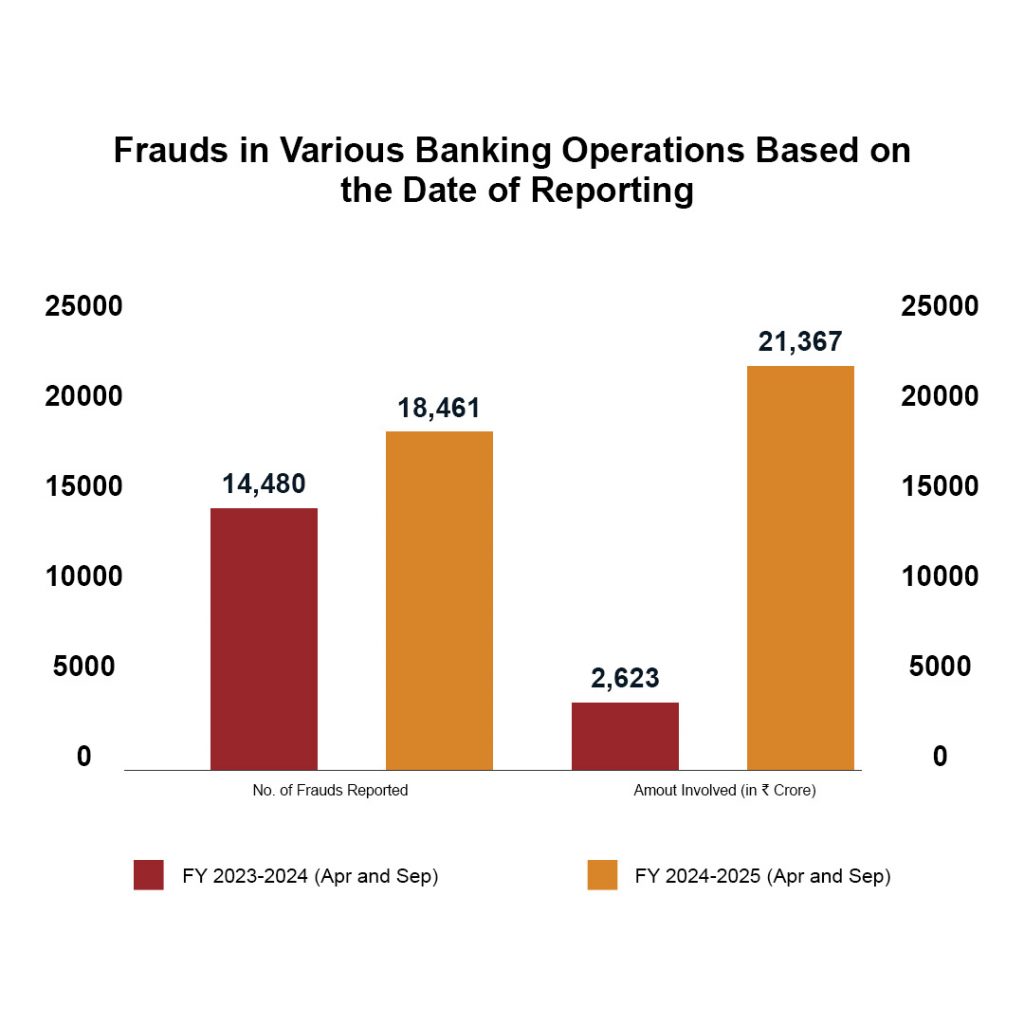

As per the report, the number of bank frauds reported between April and September saw a significant YoY (2023-24 vs. 2024) increase. The number of fraud cases reported between April and September 2023 jumped by 27% from 14,480 to 18,461 in April and September 2024.

However, the value of these frauds jumped by whooping 715% from ₹2,623 Crore between April and September 2023 to ₹21,367 Crore between April and September 2024.

The bottom line is that fraudsters are getting smarter, and the only way to stay safe is to be smarter than them.

In this blog, we will break down what digital banking frauds are, how they happen, the different types you should be aware of, and most importantly – how you can protect yourself?

What are Digital Banking Frauds?

In simple terms, digital banking fraud refers to any unauthorised or deceptive activity that aims to steal money or sensitive banking information through digital platforms. This includes internet banking, mobile banking apps, UPI, debit/credit cards, and even digital wallets.

What makes these frauds particularly dangerous is how easily they can happen – often without the victim realising until it’s too late. Whether it’s a fake phone call pretending to be your bank or a cleverly disguised phishing link, fraudsters know how to exploit both technology and human psychology.

How do Digital Frauds Happen?

Here are some common ways digital banking frauds happen:

| S. No. | Ways in Which Frauds are Done | Description |

| 1. | Phishing | Fraudulent emails or SMS with links to fake websites that capture your login credentials. |

| 2. | Vishing | Phone calls impersonating bank officials, asking for OTPs or CVV numbers. |

| 3. | Remote Access Attacks | Fraudsters trick you into installing remote access apps, giving them full control over your phone. |

| 4. | Malware | Infected apps or files that silently capture your keystrokes, passwords, or financial data. |

Types of Digital Banking Frauds (With Real-Life Examples)

Digital banking frauds come in different shapes and sizes – some sophisticated, some alarmingly simple. Here are the common types you should know about:

1. Phishing & Smishing (SMS Phishing)

We started this blog with an example of this type of digital banking fraud. These types of frauds create a sense of urgency and panic. Any unsuspecting person would panic if they received a message saying that their bank account with their hard-earned money will be freezed if they do not update their KYC details.

This is exactly how a person from Mangaluru lost ₹6.6 Lakh in an APK file scam. You can read about this real story here.

| Lesson: Never click on links received via unsolicited SMSs or emails. Always visit the official bank website directly. |

2. UPI Frauds

UPI makes payments so convenient – sometimes a little too convenient. A common tactic scammers use is that they first call their victims regarding sending them some money by mistake. Then, they send edited images of a UPI transaction to prove their claim. Next, they send a fake QR code image and ask the victims to send the money back.

Unsuspecting victims believe their claims and transfer the requested funds too. You can read more about these types of scams here.

| Lesson: Always initiate payments yourself – never authorise unknown requests, even if they claim to be refunds. |

Also Read: Jump Deposit UPI Fraud: Tips to Safeguard Your Money

3. Card Skimming

In this type of digital banking fraud, fraudsters install skimming devices to ATM machines to clone card details of the ATM users. Unsuspecting users withdraw cash, unaware their card details are being copied. The stolen data is later used to make unauthorised purchases. This is exactly how a techie from Pune lost ₹84,000.

| Lesson: Before inserting your card into an ATM machine, check for loose or unusual attachments around the card slot or keypad. |

4. SIM Swap Fraud

In SIM Swap Frauds, scammers first deactivate the victim’s SIM card and reactivate it on another device by submitting fake documents at a mobile store, in the process getting access to calls and texts, including OTPs. Recently, a businessman lost ₹7.42 crore after fraudsters took control of his phone, access their company’s bank account, and siphoned off the money.

| Lesson: If your phone loses network for no reason, contact your mobile operator immediately – it could be a SIM swap attack. |

5. Fake Loan Offers & Investment Scams

Fraudsters often lure victims by advertising instant loans or attractive investment schemes on social media or through WhatsApp messages. These offers typically promise quick approvals, no paperwork, or unbelievably high returns – all designed to create urgency and excitement. Once the victim shares personal documents or transfers a ‘processing fee’, the fraudsters vanish without a trace, or worse, misuse the personal data for further scams. This is exactly what happened to a postmaster from Ludhiana, who fell victim to a loan-related cyber fraud and ended up losing ₹87,000 instead.

| Lesson: Always verify the lender’s credentials, check if they are RBI-registered, and avoid apps or schemes that sound too good to be true. |

6. QR Code

In QR Code Scams, fraudsters trick victims into scanning a QR code under the pretext of receiving money — for selling products online, getting refunds, or winning prizes. What victims often don’t realise is that scanning the QR code actually authorises a payment from their own account. This is how a software engineer from Bengaluru lost nearly ₹2 Lakh.

| Lesson: Remember, you never need to scan a QR code to receive money — scanning a code is always for making a payment. |

Common Red Flags & Warning Signs

Fraudsters often leave clues, if you know where to look. Some red flags and warning signs include:

- Urgent or threatening messages: “Your Account will be blocked!”

- Requests for OTPs, CVV, or passwords over call/SMS.

- Emails with misspellings or suspicious links.

- Unexpected transaction alerts, even small ones.

- Unknown apps asking for excessive permissions.

A good rule of thumb: If something feels off, pause and verify directly with your bank.

What to Do If You Fall Prey to Digital Banking Fraud?

If you do become a victim, don’t panic – act fast. Here’s what you should do:

- Inform your bank immediately and ask them to freeze your account if necessary.

- Lodge a complaint at the nearest cybercrime cell via their website.

- File a complaint with the RBI Ombudsman if your bank doesn’t resolve the issue satisfactorily.

Wrapping Up!

Digital banking is here to stay! It has made managing finances easier than ever – paying utility bills, transferring money, and even investing can all happen in seconds. But just as we lock our doors before leaving the house, it is important to secure your digital banking activities too.

Fraudsters are constantly finding new ways to trick people but staying aware and alert is your best defence. Stay informed, stay safe, and keep banking smartly!

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release