IndusInd Bank Q2FY 17 Net Profit up by 26 % to Rs 704.26 crores, NIM at all time high of 4.00% Stable loan book with net credit cost of 14bps

Posted on Wednesday, October 12th, 2016 | By IndusInd Bank

Highlights Q2 FY 2017

- Undeviating quarter with robust all round growth

- Deposit growth up 39% Y-o-Y

- Credit growth up 26% Y-o-Y

- Operating profit up 27 % Y-o-Y

- Net Interest Income up 33 % Y-o-Y

- Return on Assets (ROA) at 1.93 %

- Capital Adequacy Ratio (CRAR) at 15.32 %

- Net NPA at 0.37%

Mumbai, October 12 2016: The Board of Directors of IndusInd Bank Ltd. today approved and adopted its Unaudited Financial Results for the second quarter and first half-year ended September 30, 2016.

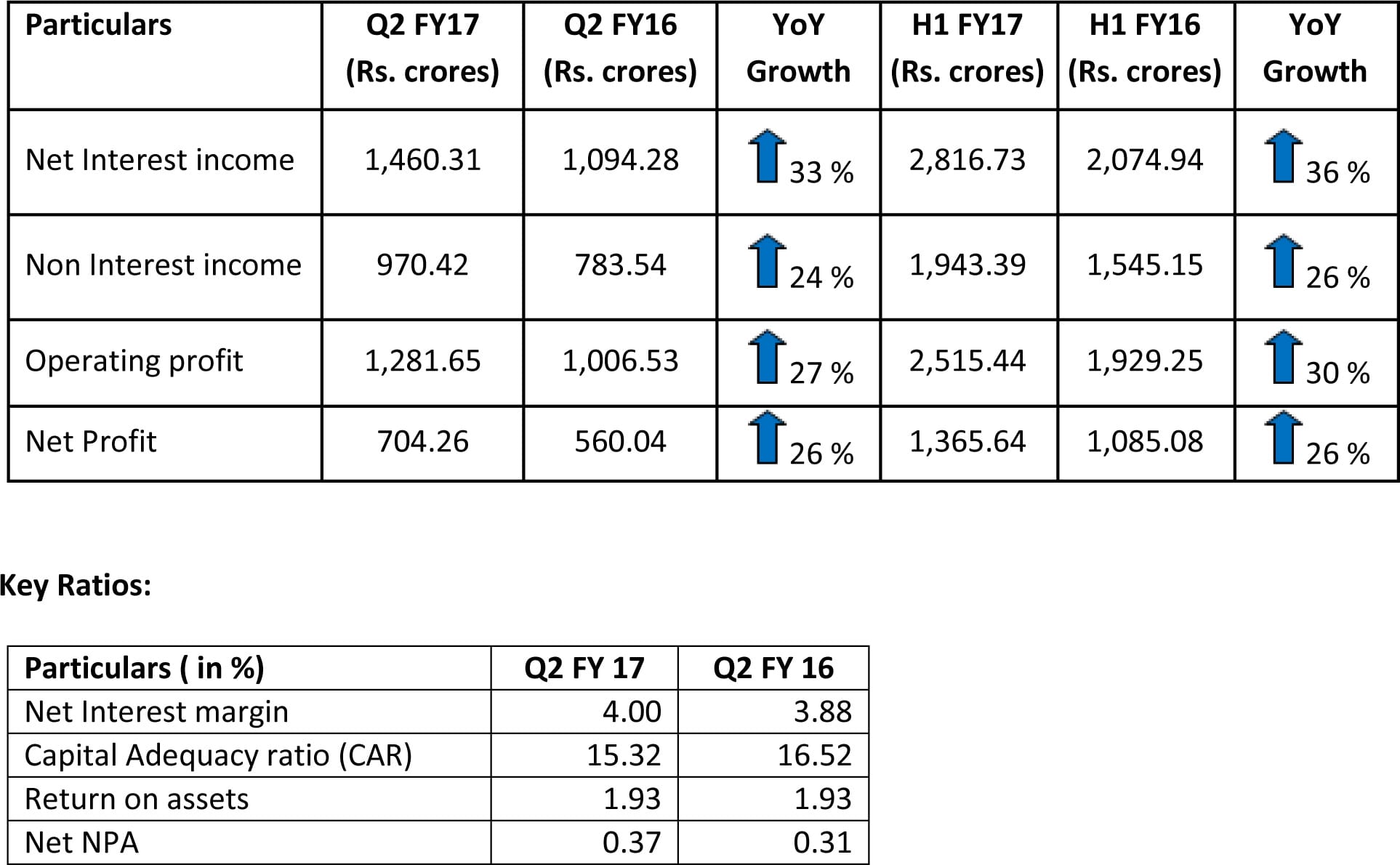

Performance Highlights at a Glance:

Performance highlights for the Quarter ended September 30, 2016:

- Net Interest Income (NII) was Rs. 1,460.31 crores as against Rs. 1,094.28 crores in the corresponding quarter of the previous year, registering a robust growth of 33 %.

- Non Interest income for the quarter was Rs. 970.42 crores as against Rs. 783.54 crores in the corresponding quarter of the previous year, a growth of 24%

- Core fee income for the quarter was Rs. 825.57 crores as against Rs. 673.30 crores in the corresponding quarter of the previous year, marking a growth of 23 %

- Operating Profit for the quarter was Rs. 1,281.65 crores as against Rs. 1,006.53 crores in the corresponding quarter of the previous year, showing a growth of 27 %.

- Net Profit for the quarter was Rs. 704.26 crores as against Rs. 560.04 crores in the corresponding quarter of the previous year, showing a growth of 26 %.

- Net Interest Margin (NIM) for the current quarter was 4.00 % as against 3.88 % in the corresponding quarter of the previous year.

Performance highlights for the Half year ended September 30, 2016:

- Net Interest Income (NII) for the half year ended September 30, 2016 was Rs. 2,816.73 crores as against Rs. 2,074.94 crores in the corresponding period of the previous year, registering a robust growth of 36 %.

- Non-Interest income was at Rs. 1,943.39 crores as against Rs. 1,545.15 crores in the corresponding period of the previous year, a growth of 26%

- Core fee income was Rs. 1,607.48 crores as against Rs. 1,309.50 crores in the corresponding period of the previous year, marking a growth of 23 %

- Operating Profit for the half year ended September 30, 2016 was Rs. 2,515.44 crores as against Rs. 1,929.25 crores in the corresponding period of the previous year, a growth of 30 %.

- Net Profit for the half year ended September 30, 2016 was Rs. 1,365.64 crores as against Rs. 1,085.08 crores in the corresponding period of the previous year, showing a growth of 26 %.

- Net Interest Margin (NIM) for the half year ended September 30, 2016 was 3.97 % as against 3.78 % in the corresponding period of the previous year.

- CASA (Current Accounts- Savings Accounts) Ratio improved to 36.53 % against 34.74 %.

- Total Advances as on September 30, 2016 were at Rs.98,949 crores as compared to Rs. 78,294 crores in the corresponding period of the previous year, recording a growth of 26 %.

- Total deposits as on September 30, 2016 were at Rs. 1,12,313 crores as compared to Rs. 80,841 crores in the corresponding period of the previous year, up by 39 %. Total Business at Rs. 2,11,262 crores.

- Net NPA as on September 30, 2016 was at 0.37% as against 0.31% as at September 30, 2015.

- Increase in network to 1,035 Branches and 1,935 ATMs as on September 30, 2016 as against 854 Branches and 1,578 ATMs as on September 30, 2015.

Commenting on the performance, Mr. Romesh Sobti, MD & CEO, IndusInd Bank said, “This quarter, the Bank has registered positive growth across all vectors despite tepid global markets and not so buoyant domestic market. However, the overall industry sentiment looks optimistic with a gradual uptick in credit pickup likely in the coming quarters. Against such backdrop, our Financial vectors remain stable and resilient with Operating Profit up by 27% and our Net Interest Income rising by a healthy 33%. Apart from steady financials, the Bank continued its focus on digitizing products and strengthening online banking as well as improving services to customers.”

About IndusInd Bank

IndusInd Bank, which commenced operations in 1994, caters to the needs of both consumer and corporate customers. Its technology platform supports multi-channel delivery capabilities. As on September 30, 2016, IndusInd Bank has 1,035 branches, and 1935 ATMs spread across 635 geographical locations of the country. The Bank also has representative offices in London, Dubai and Abu Dhabi. The Bank believes in driving its business through technology. It enjoys clearing bank status for both major stock exchanges – BSE and NSE – and major commodity exchanges in the country, including MCX, NCDEX, and NMCE. IndusInd Bank on April 1, 2013 was included in the NIFTY 50 benchmark index. Recently, IndusInd Bank ranked 13th amongst the Top 50 Most Valuable Indian Brands 2015 as per the BrandZ Top 50 rankings powered by WPP and Millward Brown.

Ratings:

- ICRA AA for Upper Tier II subordinate debt program by ICRA

- CRISIL A1+ for certificate of deposit program by CRISIL

- IND A1+ for Short Term Debt Instruments by India Ratings and Research

- IND AA for Upper Tier II subordinate debt program by India Ratings and Research

- IND AA+ for Senior unsecured bonds program by India Ratings and Research

Visit us at www.indusind.com

Twitter- @MyIndusIndBank

Facebook – https://www.facebook.com/OfficialIndusIndBankPage/

| For more details on this release, please contact: | ||

| Anu Raj | Namita Sharma | |

| IndusInd Bank Ltd. | Adfactors PR Pvt. Ltd. | |

| mktg@indusind.com | namita.sharma@adfactorspr.com 9820950663 | |

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release