IndusInd Full Year Net Profit rises 27 % Q-o-Q PAT growth at 11%

Posted on Thursday, April 16th, 2015 | By IndusInd Bank

Highlights of the Results:

- Net Profit for FY 20 15 is higher at Rs 1,794 crore compared to Rs 1,408 crore of the previous year, a growth of 27%

- Net Profit for Q4 FY 2015 is higher at Rs 495 crore as against Rs 396 crore corresponding quarter of the previous year

- Net Profit for Q4 FY 2015 is at Rs 495 crore, shows a strong growth of 11 % compared to Net Profit of Rs 447 crore of Q3 FY 2015

- Core Fee Income rises 29 %

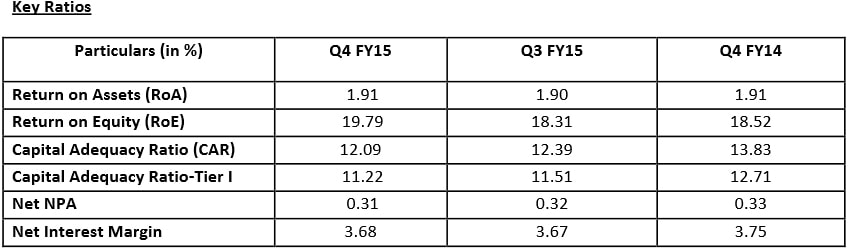

- Net Interest Margin stable at 3.68%

- Gross /Net NPAs dips 0.81% /0.31% respectively

- EPS is at Rs 33.99 as against Rs 26.85 in the previous year

- Branch Network increased to 801 branches

Mumbai , April 16, 2015:The Board of Directors of IndusInd Bank Ltd., today approved and adopted its

Financial Results for the fourth quarter and full year ended March 31, 2015.

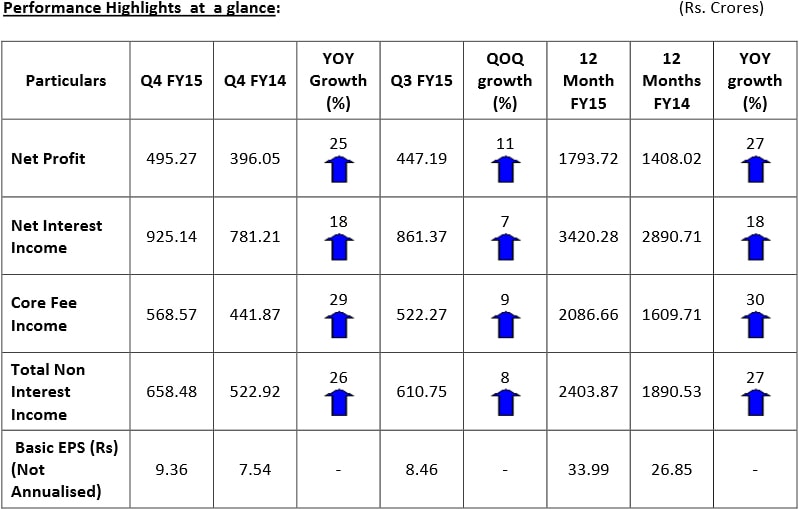

Performance highlights for the quarter ended March 31, 2015 are:

- Net Profit was Rs. 495.27 crore as against Rs. 396.05 crore in the corresponding quarter of the previous year, showing a strong growth of 25%

- Net Interest Income (NII) was Rs. 925.14 crore as compared to Rs. 781.21 crore in the corresponding quarter of the previous year, up by 18 %

- Core Fee Income was Rs 568.57 crore as compared to Rs 441.87 crore in the corresponding quarter of the previous year, up by 29%

- Total Non Interest Income was Rs. 658.48 crore as compared to Rs 522.92 crore in the corresponding quarter of the previous year, showing a growth of 26%

- Net I nterest Margin (NIM) for the current quarter was 3.68% as against 3.75 % in the corresponding quarter of the previous year

Performance highlights for the 12 -month period ended March 31, 2015 are:

- Net Profit was Rs. 1,793.72 crore as against Rs. 1,408.02 crore in the corresponding period of the previous year,recording a jump of 27%

- Net Interest Income (NII) was Rs.3,420.28 crore as compared to Rs. 2,890.71 crore in the corresponding period of the previous year, up 18%

- Total Non Interest Income was Rs 2,403.87 crore as compared to Rs 1,890.53 crore in the corresponding period of the previous year, an increase by 27%. Core Fee Income was Rs 2,086.66 crore as against Rs 1,609.71 crore, registering a growth of 30%

- Total Revenue improved to Rs. 5,824.15 crore as compared to Rs 4,781.24 crore, an increase of 22%

- CASA improved to 34.13% as against 32.55% as on March 31, 2014

- Net NPA was 0.31 % as compared to 0.33 % as on March 31, 2014

- Total Deposits increased to Rs.74,134 crore from Rs. 60,502 crore as on March 31, 2014, recording a growth of 23% for the year

- Total Advances for the year stood at Rs. 68,788 crore, recording a growth of 25% as against Rs. 55,102 crore recorded in the last year

- The full year Basic EPS works out to Rs 33.99 as against Rs. 26.85 in the previous year

- Branch Network significantly increased to 801 as against 602 branches, the previous year. The Bank’s ATMs increased to 1487 from 1110 ATMs, the previous year

- Announces a dividend of 40% as against 35%, the previous year

About IndusInd Bank

IndusInd Bank, which commenced operations in 1994, caters to the needs of both consumer and corpo rate customers. Its technology platform supports multi – channel delivery capabilities. As on March 31, 2015 , IndusInd Bank has 801 branches, and 1,487 A TMs spread across 514 geographical locations of the country. The Bank also has representative offices in London, Dubai and Abu Dhabi. It enjoys clearing bank status for both major stock exchanges – BSE and NSE – and major commodity exchanges in the country, including MCX, NCDEX, and NMCE. IndusInd Bank on April 1, 2013, was included in the NIFTY 50 benchmark index. IndusInd Bank is ranked 19th amongst the Top 50 Most Valuable Indian Brands 2014 as per the BrandZ Top 50 rankings powered by the WPP and Millward Brown.

Ratings:

- ICRA AA+ for Lower Tier II subordinate debt program by ICRA

- ICRA AA for Upper Tier II bond program by ICRA

- CRISIL A1+ for certificate of deposit program by CRISIL

- CARE AA+ for Lower Tier II subordinate debt program by CARE

- IND A1+ for Short Term Debt Instruments by India Ratings and Research

- IND AA+ for Lower Tier II subordinate debt program by India Ratings and Research

- IND AA for Upper Tier II bond program by India Ratings and Research

- IND AA+ for Senior bonds program by India Ratings and Research

| For more details on this release, please contact: | ||

| Mohit Ganju | Namita Sharma | |

| IndusInd Bank Ltd. | Adfactors PR Pvt. Ltd. | |

| Mohit.ganju@indusind.com/ 0124-4749500 | Namita.sharma@adfactorspr.com 9820950663 | |

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release