How to File ITR-1 for FY 2024–25: Online & Offline Methods Explained

Posted on Thursday, July 24th, 2025 | By IndusInd Bank

Filing your Income Tax Return (ITR) may seem overwhelming at first, but if you’re a salaried individual, the process is actually quite straightforward. The Income Tax Department has made it even simpler with ITR-1 (Sahaj)—a return form designed specifically for individuals earning up to ₹50 lakh from salary, one house property, and other sources like interest income.

This blog is exclusively for salaried individuals who are eligible to file ITR-1 for Financial Year (FY) 2024–25, i.e., Assessment Year (AY) 2025–26. We’ll walk you through how to file your return online using the e-filing portal or offline using the utility tool, along with everything else you need to get started.

Why is it Important to File ITR?

Even if your taxes are already deducted through TDS, filing an ITR isn’t just a legal obligation—it brings real advantages:

- Claim tax refunds if excess TDS was deducted

- Establish income proof for visas, loans, or government tenders

- Carry forward capital losses for future tax benefits

- Stay compliant and avoid penalties for non-filing

Filing your ITR early also reduces last-minute stress and the risk of errors.

Who Needs to File ITR-1 for FY 2024–25?

You should file ITR-1 (Sahaj) if all of the following apply:

- You are a resident individual

- Your total income is up to ₹50 lakh

- You earn income from salary or pension

- You own one house property

- You have other sources of income like savings account interest or fixed deposits

- You’re not a director in a company and don’t hold foreign assets

If you’ve changed jobs or earned a bonus this year, you’re still eligible—just make sure to consolidate all Form 16s.

Also Read: Filing Your ITR on Time: Key Deadlines & Taxpayer Implications for FY 2024–25

How to Calculate Your Taxable Income?

Before you start filing, calculate your total taxable income by adding:

- Gross salary (basic, HRA, allowances, etc.)

- Interest income (from savings, FDs, or bonds)

- Deductions under Chapter VI-A (like Section 80C, 80D, 80TTA)

Then subtract eligible deductions to arrive at your net taxable income. Use the latest income tax slab rates under the new or old regime to compute your tax liability.

Documents Required to File ITR-1

Keep the following documents handy:

- Form 16 from your employer(s)

- Form 26AS and Annual Information Statement (AIS) from the income tax portal

- Interest certificates from banks or post offices

- PAN and Aadhaar cards

- Investment proofs for deductions (if not already submitted to your employer)

- Bank account details for refund, if applicable

Pro tip: Always cross-check Form 16 with Form 26AS and AIS for any discrepancies.

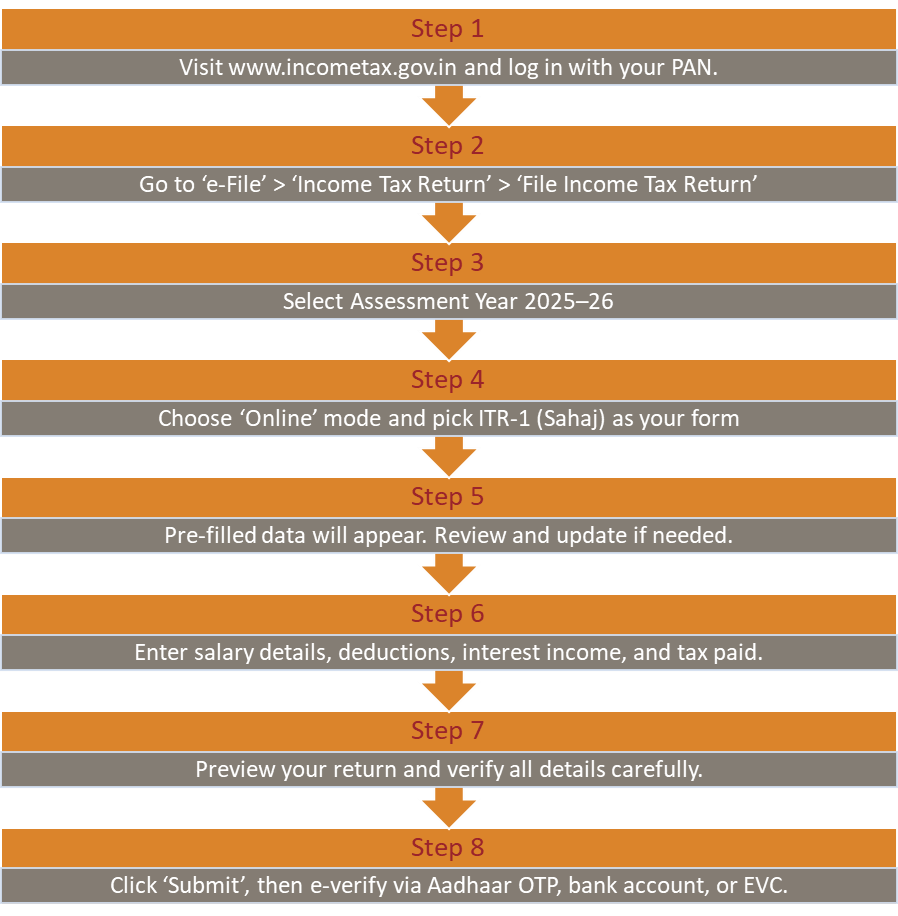

Steps to File ITR-1 Online Through E-Filing Portal

Filing ITR-1 online is the easiest way to complete your return. Here’s how to do it, based on the official income tax portal guide:

Make sure you’re using the latest version of the utility for accuracy.

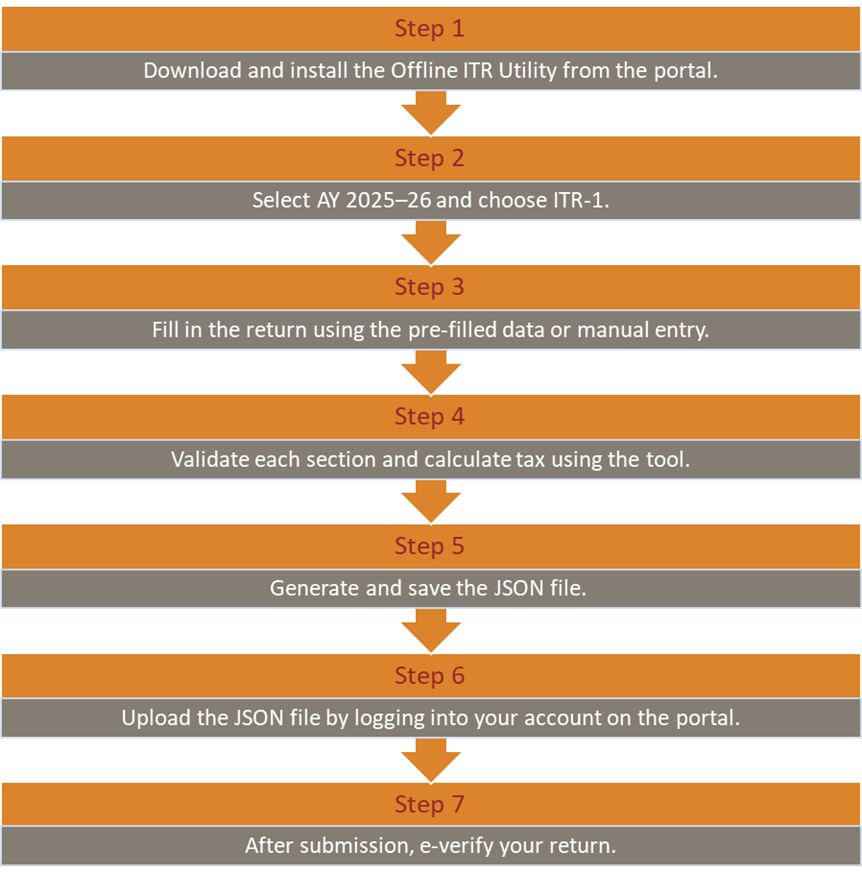

Steps to File ITR-1 Offline Using the Utility Tool

Prefer offline filing? You can use the official utility available on the Income Tax website. Here’s how:

Make sure you’re using the latest version of the utility for accuracy.

Also Read: Everything You Need to Know About ITR Filing: Forms, Process & Eligibility

How to Know if ITR-1 is the Right Form for You?

You’re eligible for ITR-1 if:

- Your total income is up to ₹50 lakh

- You earn only from salary, one house property, or other sources like interest

- You do not have capital gains, foreign assets, or business income

If you have more complex income (like rent from multiple properties, crypto gains, or freelancing), you’ll need a different ITR form such as ITR-2 or ITR-3.

Make Tax Filing Stress-Free

ITR filing doesn’t have to be a chore, especially if you’re a salaried individual using ITR-1. With online and offline options, pre-filled forms, and a clear process, it’s easier than ever to file correctly and on time.

And while banks like IndusInd Bank don’t offer tax advice, we do provide tools that make your financial life simpler, like digital account statements, instant PAN-Aadhaar linking, and real-time transaction insights.

So, block a weekend, gather your paperwork, and take control of your taxes. Your refund (and peace of mind) is just a few clicks away.

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release