Understanding the Contrast: CIBIL Score and CIBIL Rank

Posted on Tuesday, April 30th, 2024 | By IndusInd Bank

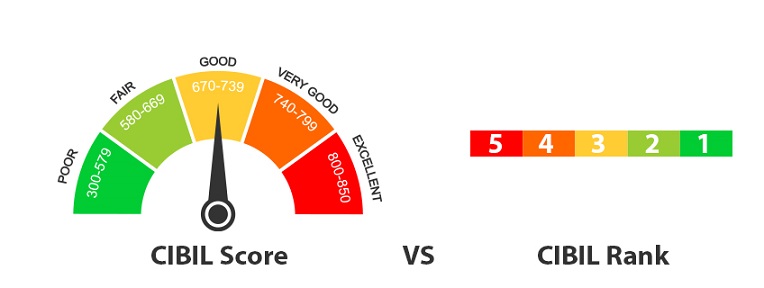

In the world of credit, terms like CIBIL score and CIBIL rank are often used widely amongst the lending industry, leading to confusion among consumers. However, these two metrics serve different purposes and offer unique insights into creditworthiness. In this blog, we’ll explore the contrast between CIBIL score and CIBIL rank, and how understanding these metrics can empower you to make informed financial decisions. Plus, we’ll highlight how IndusInd Bank Credit Cards can serve as an effective solution to boost your credit score and improve your overall credit profile.

CIBIL Score: A Measure of Creditworthiness

Your CIBIL score, also known as your credit score, is a three-digit numerical representation of your creditworthiness. It is calculated based on various factors, including your payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. A higher CIBIL score indicates lower credit risk and demonstrates responsible financial behavior.

CIBIL Rank: A Relative Comparison of Credit Profiles

While your CIBIL score provides an absolute measure of your creditworthiness, your CIBIL rank offers an insight into a company’s creditworthiness. Generally, CIBIL Rank rages on a scale from 1 to 10, with 1 being the highest rank (indicating the lowest credit risk) and 10 being the lowest rank (indicating the highest credit risk). Your CIBIL Rank helps lenders decide whether your business deserves credit and at what terms. If your CIBIL Rank falls between 1 & 4, then your organisation is deemed attractive to lenders and considered financially fit.

Understanding the Difference: Score vs. Rank

The key difference between CIBIL score and CIBIL rank lies in their use by lenders. Your CIBIL score provides a quantitative measure of your creditworthiness, allowing lenders to evaluate your risk level and likelihood of default. On the other hand, your CIBIL rank offers a glimpse into your business’ creditworthiness, letting lenders check your credit history, repayment conduct and credit utilisation.

Boosting Your Credit Score with IndusInd Bank Credit Cards

Now that you understand the importance of your CIBIL score and CIBIL rank, you may be wondering how to improve it. IndusInd Bank Credit Cards offer a powerful solution to boost your credit score and enhance your credit profile. Here’s how:

- Responsible Credit Usage: Use your IndusInd Bank Credit Card responsibly by making timely payments, keeping your credit utilization low and avoiding maxing out your card. By following these tasks, you can display your creditworthiness to lenders and improve your CIBIL score over time.

- Credit Building Opportunities: IndusInd Bank offers a range of credit cards tailored to suit different financial needs and preferences. Whether you’re new to credit or looking to rebuild your credit history, there’s a credit card option for you. By using your IndusInd Bank Credit Card wisely, you can establish and build credit effectively.

- Rewarding Benefits: IndusInd Bank Credit Cards come with various rewards programs, branded offers, and exclusive privileges that incentivize responsible financial behavior. By leveraging these benefits while managing your credit card responsibly, you can earn rewards while simultaneously boosting your credit score.

Conclusion

Understanding the contrast between CIBIL score and CIBIL rank is essential for managing your credit effectively and making informed financial decisions. While your CIBIL score provides an absolute measure of your creditworthiness, your CIBIL rank offers a similar measure of creditworthiness of your business. By leveraging the benefits of IndusInd Bank Credit Cards, you can boost your credit score, improve your credit profile, and unlock access to a world of financial opportunities. Take control of your credit journey today and build a brighter financial future with IndusInd Bank Credit Cards.

Disclaimer: The information provided in this article is generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Hence, you are advised to consult your financial advisor before making any financial decision. IndusInd Bank Limited (IBL) does not influence the views of the author in any way. IBL and the author shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information.

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release