Save Smartly with IndusInd Bank’s Fixed Deposit

Posted on Friday, July 9th, 2021 |

Present times are challenging both socially and economically, which is why keeping safe and carefully managing your finances takes precedence over other matters. What you do with your disposable income today is a far more critical decision than before. One of the finest financial instruments available to millions of Indians for decades now is a…

Read morePlanning to study abroad? Here’s why a Forex Card is a must-have

Posted on Friday, July 10th, 2020 |

Studying abroad ushers in intense excitement for all the right reasons – besides procuring a higher degree, it’s also about the numerous other highs of life. A different country, a potpourri of cultures, travel experiences and extravaganzas, socializing, learning and embracing the new you! The excitement is valid and palpable. After meticulous planning, you might…

Read moreEverything you need to know before getting a Forex card for your international trip

Posted on Tuesday, July 7th, 2020 |

Forex cards come with benefits galore. It is the cheapest way to carry money and pay in foreign currencies internationally. And, it is undoubtedly safer than carrying cash in unfamiliar places. They reduce the risk of getting robbed and protect you against forex fluctuations. So, how can you get your hands on one? IndusInd Bank…

Read moreIndusForex: The perfect travel partner for every kind of traveller

Posted on Friday, July 3rd, 2020 |

Be it a business trip or a vacation abroad, travelling tends to bring with it a sense of excitement mixed with anticipation. And the best way to fill it with good vibes and memories is by being prepared. IndusForex cards come with several exciting features that help to make transactions while abroad an effortless experience…

Read more4 Ways IndusForex makes the perfect addon for your European holiday

Posted on Wednesday, July 1st, 2020 |

Eating authentic Neapolitan pizza in Naples. Admiring the Mona Lisa in the Louvre Museum in Paris. Riding the London Eye in London. Climbing Mount Olympus in Greece. Visiting the Anne Frank Museum in Amsterdam. These are some of the beautiful, once-in-a-lifetime experiences you can look forward to during a trip to Europe. With all your…

Read moreHow are women athletes making India proud on the Global stage

Posted on Monday, August 20th, 2018 |

Young Indian female athletes are breaking long-standing records and delivering results and medals to consolidate the belief that we are making inroads in our fight for equality in all areas. Indian women athletes are as capable as men on the track – a platform to flaunt their speed and power – than they’re as capable…

Read more6 reasons to buy a credit card for your business

Posted on Wednesday, July 18th, 2018 |

Maximize returns and help your money grow at a quick rate with Fixed Deposits. Read our blog to know the benefits of investing in fixed deposits today!

Read more5 tips to use your credit card wisely

Posted on Wednesday, July 18th, 2018 |

Most of us would have experienced the joy of owning a credit card for the first time. And we all know how great a financial backup a credit card can be if used in the right manner. If used smartly, a credit card helps you manage your monthly expenses. Apart from being a powerful financial…

Read moreHow to Prevent Credit Card Fraud

Posted on Thursday, June 8th, 2017 |

Credit Cards offer a host of unique features that help us fulfil our daily requirements. Is it any wonder that they have become immensely popular with us? This increased usage though has resulted in an increase in credit card frauds as well. Therefore, knowing how to prevent such frauds is crucial. We’ve drummed up a…

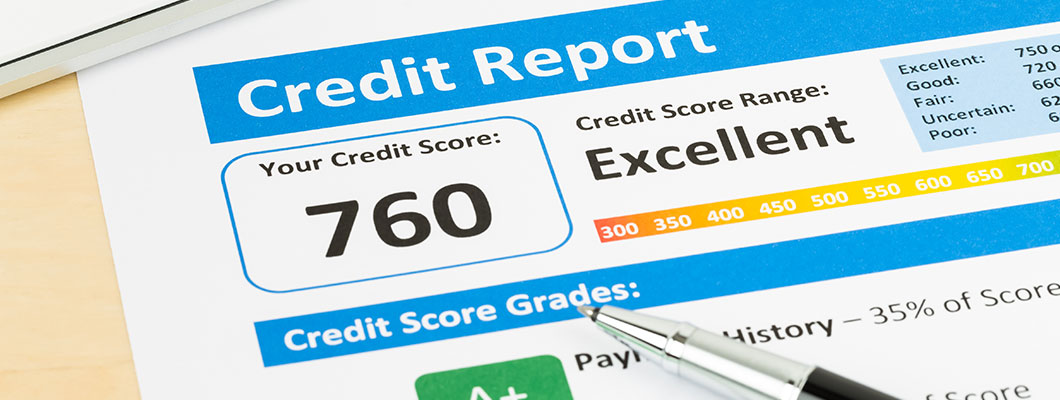

Read moreImportance of Credit Score and How to Maintain It

Posted on Thursday, June 8th, 2017 |

Whether it’s buying something as small as a smartphone or as big a commitment as a house, we always search for various credit options, such as Credit Card EMIs, Housing Loans, Personal Loans, and so on, to ease the pressure on our current financial position. While that is an intelligent decision, maintaining a good credit…

Read moreStaying Financially Secure Post-Retirement – 5 Financial Tips When Planning for Retirement

Posted on Tuesday, May 30th, 2017 |

Retirement is a reality that one needs to be very serious about, whether you are enjoying in your 20s or living in your 60s. When it comes to the subject of retirement, the right plan of action, a lot of commitment, and up to date information can take you a long way. Following are 5…

Read moreA First Time Buyer of Life Insurance? Here’s What You Need to Know

Posted on Friday, May 26th, 2017 |

Shopping for life insurance is usually an overwhelming experience for many. With a multitude of policies available in the market, picking a policy best suited to you can be tough. However, once you have learned the basics, picking the right insurance policy becomes considerably less complicated. Here are a few essential tips on buying life…

Read moreSecure Your Child’s Future Goals with Life Insurance Plans

Posted on Friday, May 26th, 2017 |

When you have children, planning for their future is paramount. This future includes their education, healthcare, general savings, and marriage even. This is where buying a life insurance for your children can be beneficial. A life insurance policy for kids can build cash value over the years, thus proving to be practical and useful in…

Read moreMake Life Less Taxing, Save Money While Investing in Life Insurance!

Posted on Friday, May 26th, 2017 |

Life can be quite uncertain and highly unpredictable, with no answer as to when an unfortunate accident might strike. In the unlikely situation of anything happening to us, our priority is always to ensure that our loved ones are taken care of in our absence. Which is where opting for a life insurance becomes necessary…

Read moreWhat is the CIBIL Score Required for Personal Loans?

Posted on Friday, April 28th, 2017 |

One can’t predict when a sudden need for funds might arise. It is, therefore, advisable to keep your credit record spotless. A bad credit/CIBIL score, arising from late payment or non-payment of credit card bills, can severely hamper your attempt to procure a personal loan. However, having a good CIBIL score will considerably improve your…

Read moreSaving Money in Your 20s – It’s Easier Than You Think

Posted on Wednesday, April 5th, 2017 |

Your twenties are a tumultuous time. You are out of college, you probably have your first job, and you are finally coming to terms with the fact that you need to manage your money. While you are going to be tempted to spend excessively, it is going to cost you in the long run. Saving…

Read moreKnow which credit card works the best for you

Posted on Tuesday, March 28th, 2017 |

If you think that applying for a credit card is a complicated and time-consuming affair, we are here to prove you wrong. With IndusInd Bank, you can now apply for and receive the credit card of your choice from the comfort of your home, or even on the go. What’s more, IndusInd Bank’s hassle-free online application…

Read moreGet a Hassle Free Two Wheeler Loan

Posted on Friday, March 17th, 2017 |

Have you been thinking of buying a two-wheeler? At IndusInd Bank, it is a simple process to get a loan for a two-wheeler of any brand, with attractive interest rates and easy repayment options as additional benefits. Keeping these things in mind, get a fast and easy loan in no time: An easy online application…

Read moreIs Converting Credit Card Debts Into Personal Loan Beneficial?

Posted on Tuesday, August 30th, 2016 |

Availing a personal loan to pay your credit card debt has become a common tool to get rid of the debt spiral. Today, credits are easily available. There is absolutely no system to caution you about your credit management capacities. And access to multiple credit cards, coupled with the above, lands you in a debt…

Read more7 Tips to Derive The Best From Balance Transfer Credit Card

Posted on Friday, August 19th, 2016 |

Balance transfer of your credit outstanding to a lower interest-charging credit card is a tidy technique to trim the debt fat that accumulates around the principal amount. Many leading banks offer attractive rates and payment options for balance transfer. Switching from a higher interest rate to a lower rate has become an easy affair with…

Read more

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release