The importance of an EMI calculator in getting a personal loan

Posted on Tuesday, November 28th, 2023 |

When it comes to fulfilling your financial aspirations or tackling unexpected expenses, a personal loan is often the go-to solution. It offers the flexibility and liquidity that can help you achieve your goals without draining your savings. However, understanding the financial implications is crucial before you embark on your loan journey. This is where a…

Read moreTop benefits of personal loan EMI calculator

Posted on Tuesday, November 28th, 2023 |

Financial planning is a critical aspect of effective expense management. When it comes to a personal loan, staying on top of your Equated Monthly Installments (EMIs) is crucial. This is where the personal loan EMI calculator becomes a trustworthy tool. Whether navigating financial hardships or meeting urgent needs, a personal loan is beneficial, but it…

Read moreQuick Guide to Applying for an Instant Personal Loan Online

Posted on Friday, September 22nd, 2023 |

Whether it’s for a medical emergency, home repair, or a last-minute trip, having access to quick funds can be a lifesaver. This is where an instant personal loan comes into play, offering a hassle-free solution to address urgent financial requirements. In this comprehensive guide, we’ll walk you through the process of applying for a personal…

Read moreCan I Get a Personal Loan If My Monthly Salary is ₹25,000?

Posted on Monday, June 26th, 2023 |

When financial needs arise, a personal loan can be a convenient option to meet your expenses. However, a common concern among individuals with a salary of ₹25,000 is whether they will qualify for a personal loan or not. In this blog, we will explore the possibilities and shed light on the factors that lenders consider…

Read moreWho is Eligible to Apply for a Personal Loan?

Posted on Monday, June 26th, 2023 |

Personal loans have become a popular financial tool for individuals seeking funds to fulfill their immediate needs or manage unexpected expenses. Whether it’s funding home improvements or covering medical bills, an instant personal loan is a flexible borrowing option to suffice your needs. However, it’s crucial to understand the eligibility criteria and factors that influence…

Read moreDoes IndusInd Bank Offer Personal Loan Easily?

Posted on Tuesday, June 20th, 2023 |

Personal loans have become the go-to choice for many individuals when it comes to meeting financial needs. Among the numerous financial institutions providing personal loans, IndusInd Bank is a prominent player in the Indian banking sector. In this blog post, we will explore whether IndusInd Bank offers personal loans easily, examining the bank’s loan application…

Read moreDifferences Between Secured and Unsecured Personal Loan.

Posted on Tuesday, May 2nd, 2023 |

A personal loan is an excellent way to finance important expenses such as home renovation, wedding expenses, unexpected medical bills, and more. There are two types of personal loan options available: secured and unsecured. It’s important to understand the differences between these two types of loans before deciding which one is right for you. Secured…

Read morePersonal Loan: How to Improve Your Chances of Getting Approved?

Posted on Wednesday, April 26th, 2023 |

A Personal loan can be a great way to fund a big purchase, consolidate debt, or handle an unexpected expense. However, obtaining an approval can sometimes be challenging. Lenders have strict requirements and qualifications that you must meet to be eligible for a personal loan. If you’re looking to improve your chances of getting approved…

Read moreHow to get a higher personal loan at low EMI?

Posted on Tuesday, April 25th, 2023 |

A personal loan is a popular financial product that can be used for a variety of purposes, from paying for unexpected expenses to funding a vacation or home renovation project. One of the key factors to consider when taking out an instant personal loan is the interest rate, as this will determine how much you…

Read moreWhy IndusInd Bank is the Right Option for Online Personal Loans?

Posted on Wednesday, January 12th, 2022 |

A personal loan is like the proverbial all-weather friend that stands by you in this hour of need. Be it an unforeseen medical emergency, an opportunity to obtain higher education abroad, or a long-awaited home renovation, a personal loan helps fulfil an array of needs that may arise over the course of one’s life. Popular…

Read moreHow Can You Get a Low Interest Rate on an IndusInd Easy Credit Personal loan?

Posted on Tuesday, September 14th, 2021 |

Having access to funds whenever you are in an urgent financial need is a power we all wish we had. But life doesn’t work that way as financial problems can arise out of nowhere. In such challenging situations, a low interest personal loan can be your saviour! More so, if it is by a modern…

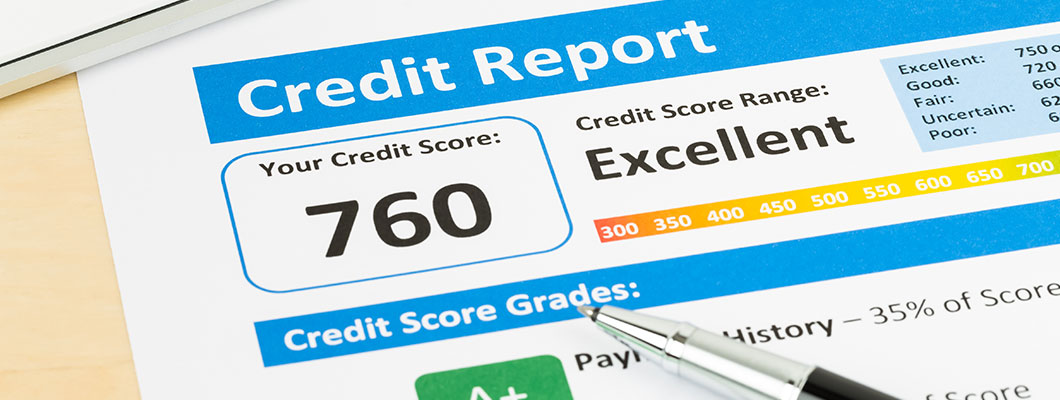

Read moreMyths Debunked About CIBIL Score for a Personal Loan

Posted on Tuesday, August 3rd, 2021 |

The saying “Half knowledge is more dangerous than ignorance”, is especially true when it comes to your credit score and how it relates to your loan approval. Your credit or CIBIL score defines your creditworthiness and, in turn, decides whether your bank will approve or reject your personal loan application. To have a smooth borrowing…

Read morePersonal Loan in Times of COVID-19 – Should You Apply for One?

Posted on Tuesday, April 20th, 2021 |

The coronavirus pandemic continues to change the definition of ‘normal’ for everyone. The tremendous disruption brought about by COVID-19 ended up jolting the global economic landscape. With the economic slowdown and so much more happening simultaneously, managing your finances can be a tough task. And the nation-wide lockdown made this chore even more challenging. With…

Read moreWhat is the CIBIL Score Required for Personal Loans?

Posted on Friday, April 28th, 2017 |

One can’t predict when a sudden need for funds might arise. It is, therefore, advisable to keep your credit record spotless. A bad credit/CIBIL score, arising from late payment or non-payment of credit card bills, can severely hamper your attempt to procure a personal loan. However, having a good CIBIL score will considerably improve your…

Read more

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release