Here’s How you can Load Cash in Forex Cards

Posted on Thursday, October 28th, 2021 |

Do you love going on family vacations? Or does your work require you to travel abroad frequently? Then you must have heard of a forex card. Or maybe you already have one! It is undoubtedly the most effective way to carry money when you’re travelling abroad. A multi-currency forex card such as the one offered…

Read moreReasons Why Forex Card is a Better Payment Option Than Credit Card While Travelling Abroad

Posted on Friday, August 13th, 2021 |

When travelling abroad, what is the safest way to carry money? A credit card seems like a convenient choice. However, there is a more economical yet equally convenient payment method – forex cards! Like credit cards, they allow you to make purchases at any merchant POS terminals; simply swipe/tap and buy on the go. They…

Read moreThings to Keep in Mind Before Taking a Personal Loan

Posted on Friday, April 28th, 2017 |

Personal loans are the fastest and the most convenient form of credit today. Fast approval coupled with speedy disbursal and no collateral make it the credit instrument of choice during emergencies. People also have been using these loans for home renovation, financing weddings, education and sometimes even vacations. However, before taking a personal loan, there…

Read moreWhy You Should Start Saving for Retirement in Your 30s

Posted on Wednesday, April 5th, 2017 |

Very few people think about saving for retirement in their 20s. This can be due to pre-existing student loans which they have to pay off, or they are simply not earning enough. However, by your 30s, saving should not be an afterthought, but a priority. Aside from life insurance, you need a little more security…

Read moreNRI Taxation: Know the Tax Implications for NRIs in India

Posted on Tuesday, October 4th, 2016 |

The Income Tax Department of India defines an NRI, or a Non-Resident Indian, as an individual of Indian origin but living outside the Indian subcontinent. The Section 6 of the Indian Income Tax Act defines the NRI status of an individual more precisely. According to this section, an individual is considered an NRI if, ?…

Read moreCIBIL Score: Why is important?

Posted on Monday, October 3rd, 2016 |

CIBIL, Credit Information Bureau India Limited, is an important part of the financial system in India as it provides critical credit information about every individual and rates them based on their creditworthiness. The system has its own way of analysis which results in a credit rating for every individual called the CIBIL score. The CIBIL…

Read moreAdvantages of Pre and Part- Payments of Personal Loan

Posted on Wednesday, September 7th, 2016 |

Before diverting the extra cash or savings towards pre-payment or part-payment of your personal loan, you shall always consider its impact. Whether the decision of not serving the entire loan tenure would be beneficial or not shall always be your primary concern. Pre-paying your loan can be beneficial but such benefit depends on the sum…

Read moreWhen To Finance Your Business With A Personal Loan

Posted on Wednesday, September 7th, 2016 |

Thousands of new and innovative ideas are being constructed into business ventures every year. India’s business sector is gaining momentum having more than 4,000 startups to its credit during the year 2015. With the call for business development comes the need for finance. There are many business loan products available in the market today for…

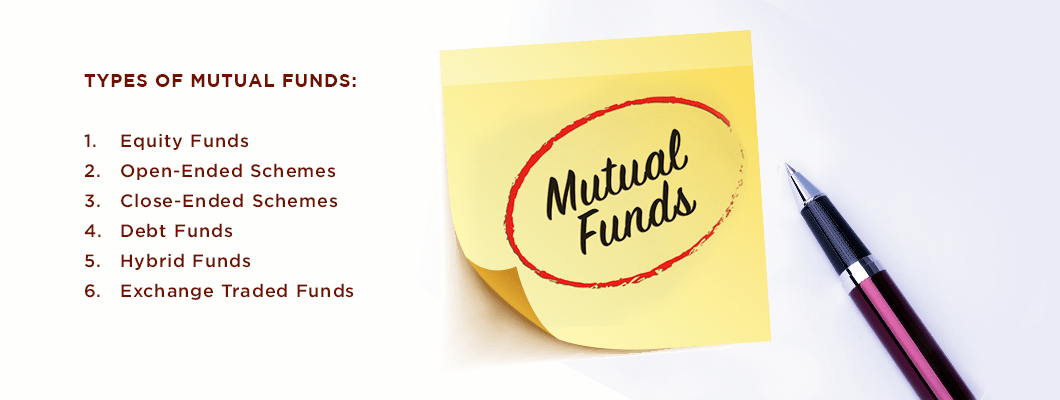

Read more6 Types of Mutual Funds That Every Investor Must Know

Posted on Friday, August 19th, 2016 |

Depending on one’s affinity for investments, investors can be divided into two categories – those who take risks and those who prefer to play it safe. Irrespective of the category you belong to, mutual funds can act as a preferred investment option. Mutual funds allow investors to invest in bonds, stocks and other securities, with…

Read more

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release