How do you choose the right IndusInd Credit Card?

Posted on Saturday, October 21st, 2023 |

Browsing through credit card options to find “the one” can be overwhelming. But no need to worry! IndusInd Bank has an array of credit card offers designed to suit your individual needs. Whether you are a frequent traveller, a foodie, or someone looking for payment flexibility, this article will help you choose the right IndusInd…

Read moreMore Trips Abroad with a Multi-Currency Forex Travel Card!

Posted on Monday, July 10th, 2017 |

Thanks to technology and globalisation, travelling to distant lands for work as well as leisure is fairly easy in today’s times. With about 65 million passport holders in the country, India is pretty active on the international travel scene. According to a survey, an average of INR 2,55,100 was spent during travels by Indians in…

Read moreThings to Keep in Mind Before Taking a Personal Loan

Posted on Friday, April 28th, 2017 |

Personal loans are the fastest and the most convenient form of credit today. Fast approval coupled with speedy disbursal and no collateral make it the credit instrument of choice during emergencies. People also have been using these loans for home renovation, financing weddings, education and sometimes even vacations. However, before taking a personal loan, there…

Read moreWhy You Should Start Saving for Retirement in Your 30s

Posted on Wednesday, April 5th, 2017 |

Very few people think about saving for retirement in their 20s. This can be due to pre-existing student loans which they have to pay off, or they are simply not earning enough. However, by your 30s, saving should not be an afterthought, but a priority. Aside from life insurance, you need a little more security…

Read moreSupport Demonetisation, Go Cashless

Posted on Tuesday, January 31st, 2017 |

With Honorable Prime Minister Narendra Modi’s announcement regarding demonetisation, high-denomination notes of Rs. 1000 and Rs. 500 have become void. Demonetisation is one of the boldest decisions taken by the Indian government to curb black money and achieve the vision of “Digital India”. One way to support demonetisation and make daily transactions easily is by…

Read moreNRI Taxation: Know the Tax Implications for NRIs in India

Posted on Tuesday, October 4th, 2016 |

The Income Tax Department of India defines an NRI, or a Non-Resident Indian, as an individual of Indian origin but living outside the Indian subcontinent. The Section 6 of the Indian Income Tax Act defines the NRI status of an individual more precisely. According to this section, an individual is considered an NRI if, ?…

Read moreCIBIL Score: Why is important?

Posted on Monday, October 3rd, 2016 |

CIBIL, Credit Information Bureau India Limited, is an important part of the financial system in India as it provides critical credit information about every individual and rates them based on their creditworthiness. The system has its own way of analysis which results in a credit rating for every individual called the CIBIL score. The CIBIL…

Read moreAdvantages of Pre and Part- Payments of Personal Loan

Posted on Wednesday, September 7th, 2016 |

Before diverting the extra cash or savings towards pre-payment or part-payment of your personal loan, you shall always consider its impact. Whether the decision of not serving the entire loan tenure would be beneficial or not shall always be your primary concern. Pre-paying your loan can be beneficial but such benefit depends on the sum…

Read moreWhen To Finance Your Business With A Personal Loan

Posted on Wednesday, September 7th, 2016 |

Thousands of new and innovative ideas are being constructed into business ventures every year. India’s business sector is gaining momentum having more than 4,000 startups to its credit during the year 2015. With the call for business development comes the need for finance. There are many business loan products available in the market today for…

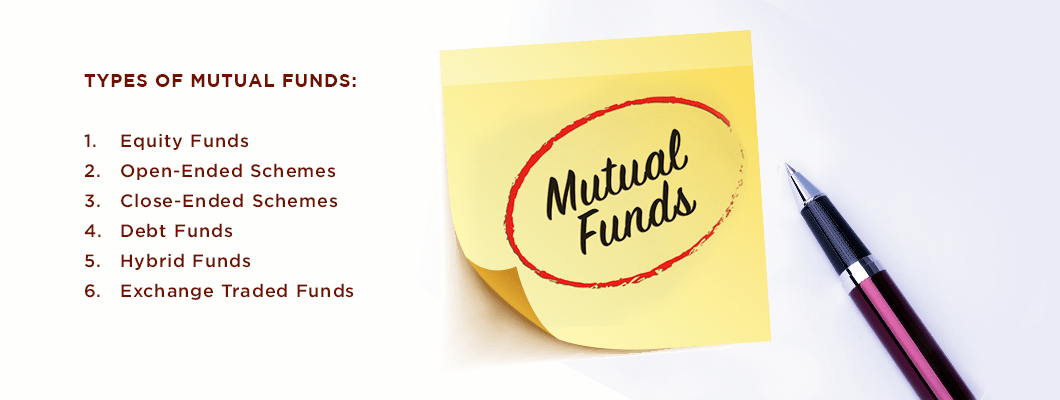

Read more6 Types of Mutual Funds That Every Investor Must Know

Posted on Friday, August 19th, 2016 |

Depending on one’s affinity for investments, investors can be divided into two categories – those who take risks and those who prefer to play it safe. Irrespective of the category you belong to, mutual funds can act as a preferred investment option. Mutual funds allow investors to invest in bonds, stocks and other securities, with…

Read morePlanning a holiday? Reach for your credit card! How plastic money is making vacations more fun.

Posted on Tuesday, May 31st, 2016 |

With the April-May holidays here, families across India are getting ready for the great summer getaway. Parents with kids, bored after the closure of schools, look forward to the day when they set out for the airport, for their next big adventure! Young people start thronging airports seeking to explore new destinations, while nuclear families…

Read moreSME Banking – A Different Approach and a Different Mindset

Posted on Thursday, November 19th, 2015 |

The time is ripe for banks to step up their efforts to serve small and medium-sized enterprises (SMEs) in Indian markets. With innovations in technology, newer business models, increased thrust on encouraging SMEs and encouraging regulations, banks are overcoming traditional barriers and finding ways to partner with SMEs profitably. The banking solutions that work for…

Read moreRising Customer Expectations And Diminishing Customer Loyalty – Key Influencer For Innovation

Posted on Thursday, November 19th, 2015 |

Change is a – constant’s and changing dynamics in the banking landscape have brought forth the need for innovation. With new guidelines from RBI, the stage is set for competitive banking. The changing profile of a customer who has high expectations from his bank is keeping the banking industry anxious and eager to find right…

Read moreIndusInd Bank enters into an agreement to acquire RBS’s Diamond & Jewellery Financing business in India…

Posted on Monday, June 29th, 2015 |

Read more

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release