IndusInd Bank Platinum RuPay Credit Card: Setting It Apart from the Rest

Posted on Tuesday, April 30th, 2024 |

In the competitive landscape of credit cards, finding the right one that aligns with your lifestyle and financial goals can be a daunting task. However, when it comes to exceptional value, rewards, and benefits, the IndusInd Bank Platinum RuPay Credit Card stands out as a top contender. In this blog, we’ll explore what sets the…

Read moreConvenient Grocery Shopping: Exploring UPI Payment Options with Credit Cards

Posted on Tuesday, April 30th, 2024 |

With the rise of digital payment methods, consumers now have more choices than ever when it comes to making transactions. One such option that has gained popularity is Unified Payments Interface (UPI), which offers a seamless and secure way to pay for goods and services, especially groceries. In this blog, we’ll explore the convenience of…

Read moreA Comprehensive Guide for Gen Z: Maintaining a Stellar Credit Score

Posted on Tuesday, April 30th, 2024 |

Generation Z, born roughly between the mid-1990s and early 2010s, is stepping into adulthood in an era defined by rapid technological advancements and evolving financial landscapes. As this dynamic generation begins to navigate the complexities of financial independence, one crucial aspect to consider is building and maintaining a stellar credit score. In this blog, we’ll…

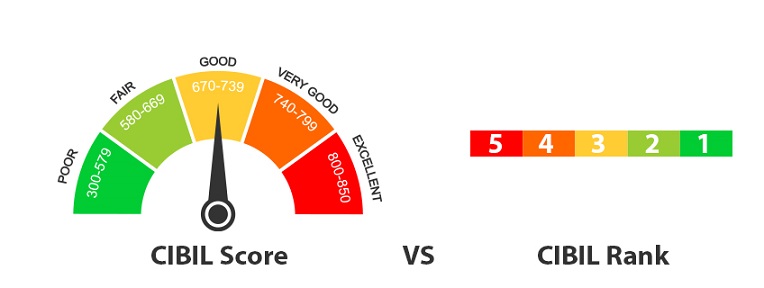

Read moreUnderstanding the Contrast: CIBIL Score and CIBIL Rank

Posted on Tuesday, April 30th, 2024 |

In the world of credit, terms like CIBIL score and CIBIL rank are often used widely amongst the lending industry, leading to confusion among consumers. However, these two metrics serve different purposes and offer unique insights into creditworthiness. In this blog, we’ll explore the contrast between CIBIL score and CIBIL rank, and how understanding these…

Read moreTitle: Decoding the Credit Habits of Millennials: Insights and Strategies

Posted on Tuesday, April 30th, 2024 |

Millennials, often referred to as the generation born between the early 1980s and mid-1990s, have been reshaping the economic landscape with their unique financial behaviors and preferences. From their approach to saving and investing to their attitudes towards credit and debt, millennials’ financial habits are a topic of interest and scrutiny. In this blog, we…

Read moreTitle: Stay Ahead: Shield Your Credit Score the Smart Way

Posted on Tuesday, April 30th, 2024 |

Your credit score is more than just a number; it reflects your financial health and credibility. Whether you’re applying for a loan, renting an apartment, or even getting a new job, your credit score plays a significant role in shaping your financial future. That’s why it’s essential to take proactive steps to safeguard and improve…

Read moreSecuring Your Child’s Future: The Role of Fixed Deposits

Posted on Tuesday, April 30th, 2024 |

Ensuring a bright and secure future for our children is a top priority for parents. While there are numerous avenues to invest in their future, fixed deposits (FDs) emerge as a reliable option offering stability, security, and growth potential. Let’s delve into how FDs can play a pivotal role in securing your child’s future. Financial…

Read moreUnlocking Your Summer Holiday Shopping Potential with Credit Cards

Posted on Tuesday, April 30th, 2024 |

As the summer sun beckons, it’s time to embark on the season of travel, relaxation, and fun-filled adventures. Whether you’re planning a beach getaway, a mountain retreat, or a cultural exploration, your summer holiday is the perfect opportunity to indulge in some well-deserved shopping therapy. And what better way to make the most of your…

Read moreInvesting in Fixed Deposits: Building a Better Future

Posted on Tuesday, April 30th, 2024 |

In a world where financial stability is paramount, investing wisely becomes essential. While there are numerous investment options available, fixed deposits stand out as a reliable choice, offering a secure avenue for individuals to grow their wealth and secure their future. Stability and Security Fixed deposits, often referred to as term deposits, are investments offered…

Read moreVacations in Golden Years: Using Savings Accounts to Fund Your Dream Trips

Posted on Tuesday, April 30th, 2024 |

As we enter the golden years of our lives, the desire to explore and experience new adventures often grows stronger. Retirement opens up a world of possibilities, allowing us the time and freedom to travel and indulge in the experiences we’ve always dreamed of. However, making these dreams a reality requires careful financial planning and…

Read moreFunding Adventure Packed Travel Plans with Savings Account

Posted on Tuesday, April 30th, 2024 |

In today’s fast-paced world, the urge to explore new destinations and embark on thrilling adventures is stronger than ever. However, financing these escapades can often pose a challenge. While some may resort to dipping into their monthly income or taking out loans, there’s a smarter way to fund your travel dreams – through your savings…

Read moreFine Dining and Online Food Ordering: Exploring the Best IndusInd Bank Credit Cards

Posted on Tuesday, April 30th, 2024 |

In today’s bustling world, dining experiences have gone beyond as a mere sustenance activity — they have become an opportunity to indulge in gastronomic delights and create unforgettable memories. Recognizing the growing importance of enhancing these experiences, IndusInd Bank brings to you two exclusive dining credit cards: the IndusInd Bank EazyDiner Credit Card and the…

Read moreUnlocking the Power of Online Credit Card Applications: A Step-by-Step Guide

Posted on Tuesday, April 30th, 2024 |

In this rapidly changing world, convenience is no longer a matter of luxury but a necessity. And nowhere does this hold more truth than managing our finances. But do you still face the hassles of paperwork, documentation etc. while applying for a new credit card? Enter online credit card applications – a game-changer in the…

Read moreUnderstanding the Differences Between ‘Buy Now Pay Later’ and Personal Loans

Posted on Tuesday, April 30th, 2024 |

In today’s consumer landscape, there are numerous options available for financing purchases and managing expenses. Two popular options that have gained traction in recent years are ‘Buy Now Pay Later’ (BNPL) services and personal loans. While both offer consumers the flexibility to spread out payments over time, they operate differently and cater to different financial…

Read moreHow Personal Loans Can Impact Your Credit Score

Posted on Tuesday, April 30th, 2024 |

In personal finance, credit scores play a crucial role in determining an individual’s financial health and access to credit. Whether you’re considering applying for a personal loan or already have one, understanding how personal loans can impact your credit score is essential. In this blog post, we’ll explore the various ways personal loans can influence…

Read moreUnderstanding the Loan Recovery Process

Posted on Tuesday, April 30th, 2024 |

In the world of personal finance, obtaining a loan can be a lifeline during times of financial need. However, it’s essential to understand that borrowing money comes with the responsibility of repayment. In some cases, borrowers may find themselves unable to meet their repayment obligations, leading to the loan recovery process. In this comprehensive guide,…

Read moreHow To Check Bank Balance

Posted on Monday, April 29th, 2024 |

No more waiting in queues or waiting for your bank statement to arrive by mail just to know your bank balance. In today’s era, finding your bank balance has become much more convenient, just like how easy it is to open a bank account online. There’s a way to suit everyone’s preferences, be it traditional…

Read moreDiscovering ATMs: How They Operate

Posted on Monday, April 29th, 2024 |

What does an ATM do? Let us first understand the full form of ATM. ATM stands for Automated Teller Machine. It is a computerised device that acts as an electronic banking outlet, allowing customers of financial institutions to perform various transactions without the help of a human teller or branch representative. Anyone can use the…

Read moreBenefits of Using a Credit Card for Home Renovations and Improvement Projects

Posted on Monday, April 29th, 2024 |

Home renovation projects are exciting for all, brimming with the promise of transformation and improvement. Whether it’s a fresh coat of paint, a stylish kitchen upgrade, or a complete overhaul, the desire to enhance our living spaces is universal. While the desire to breathe new life into our living spaces may be strong, the reality…

Read moreHow to Deposit Money into a Bank Account?

Posted on Monday, April 29th, 2024 |

Have you ever felt unsure about the best way to deposit money into your bank account? Perhaps you are depositing a cheque or simply moving funds between accounts to manage your savings. No matter the situation, it is crucial to have a simple, secure, and convenient way to make sure your funds are efficiently processed…

Read more

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release